9th Jun 2021. 7.47am

Regency View:

Morning Report – Wednesday 9th June

FTSE to open at 7,079 (-16 pts)

For the second consecutive session, US stocks tread water just below all-time highs as bond yields continue to move lower following last Friday’s worse-than-expected non-farm payrolls – soothing the markets inflationary fears.

In Asia, the FT is reporting that a Covid-19 outbreak in southern China is “curbing activity at some of the country’s biggest ports, stoking fears that further disruption in international trade risk pushing up the price of its exports”. And stocks in Hong Kong are trading near two-week lows.

Our Risk Barometer is in neutral territory as we head into European trading.

| S&P 500 | +0.02% | Neutral for UK stocks |

| Hang Seng | -0.28% | Bearish for UK stocks |

| Gold | -0.04% | Neutral for UK stocks |

| AUD/JPY | +0.05% | Neutral for UK stocks |

| US 10yr Yield | -2.61% | Bullish for UK stocks |

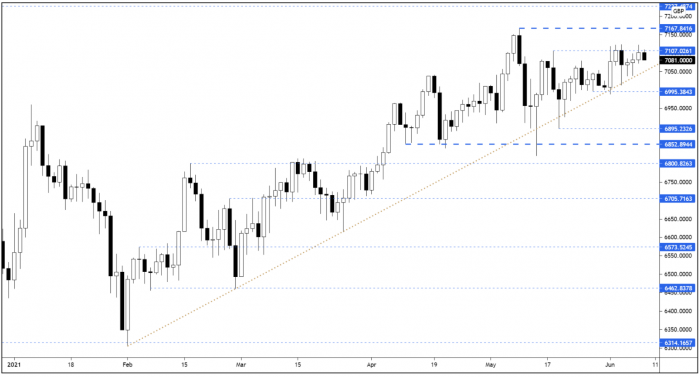

Yesterday’s price action saw the FTSE fail to break and close above swing resistance at 7,107. This has been followed by a small move lower on the futures overnight.

The market is now being funneled between the ascending trendline which has been in place since November and those horizontal swing highs.

| Interim Results |

| Thungela Res (TGA) |

| Mti Wireless (MWE) |

| UK Economic Announcements |

| (00:01) RICS Housing Market Survey |

| International Economic Announcements |

| (07:00) Wholesale Price Index (GER) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.