8th Dec 2021. 7.45am

Regency View:

Morning Report – Wednesday 8th December

FTSE to open at 7,329 (-11 pts)

Wall Street posted its biggest one-day gain since March yesterday as fears over the severity of the Omicron variant subsided, and Chinese authorities showed a willingness to stimulate the country’s slowing economy.

Asian stocks have had a mixed session with Japanese stocks continuing Wall Street’s rally, but Chinese stocks lagging due to news that Beijing will tighten rules for tech companies seeking foreign funding.

| S&P 500 | +2.07% | Bullish for UK stocks |

| Hang Seng | -0.02% | Neutral for UK stocks |

| Gold | +0.35% | Bearish for UK stocks |

| AUD/JPY | -0.04% | Neutral for UK stocks |

| US 10yr Yield | +2.73% | Bearish for UK stocks |

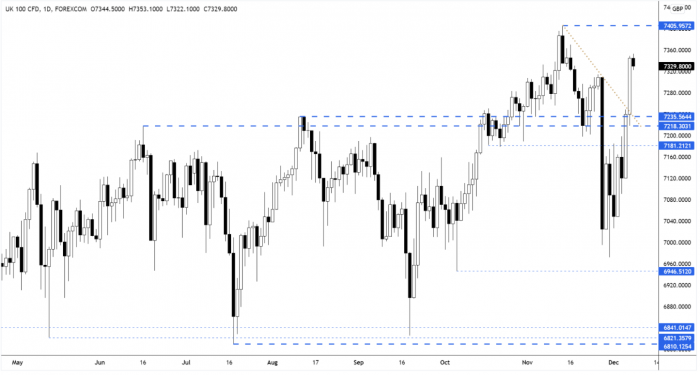

The strong drive higher continued to gather momentum yesterday and prices are now back within 70 points of their November highs.

This has been a near vertical 300 point rally from last week’s lows, so it wouldn’t be too surprising to see the market take a pause for breath and consolidate sideways for a few sessions.

| Final Results |

| Hardide (HDD) |

| SSP Group (SSPG) |

| Interim Results |

| Berkeley Group (BKG) |

| Quiz (QUIZ) |

| Trading Announcements |

| Mccoll’s (MCLS) |

| International Economic Announcements |

| (12:00) MBA Mortgage Applications (US) |

| (15:30) Crude Oil Inventories (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.