5th Oct 2022. 7.46am

Regency View:

Morning Report – Wednesday 5th October

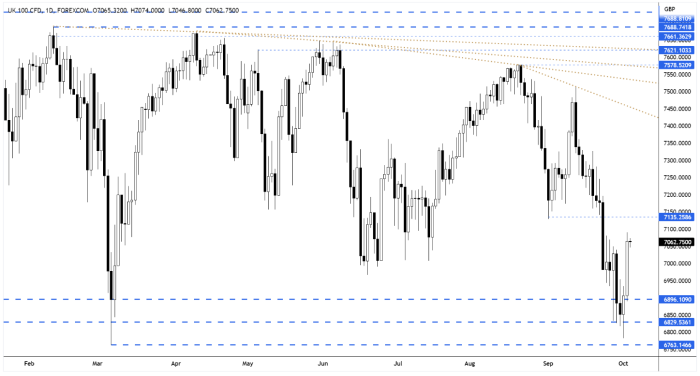

FTSE to open at 7,071 (-15 pts)

The S&P 500 added a further 3% of gains on Tuesday as weak employment data from the Bureau of Labor Statistics stoked hopes that the Fed might be forced to slow the pace of its interest rate rises.

Asian stocks have followed Wall Street higher with Hong Kong’s Hang Seng surging more than 6% higher as the market returned from a holiday.

In Europe, EU member states are closing in on a deal to impose a price cap on Russian oil as they seek to drive down the Kremlin’s revenues.

| S&P 500 | +3.06% | Bullish for UK stocks |

| Hang Seng | +6.24% | Bullish for UK stocks |

| Gold | -0.17% | Neutral for UK stocks |

| AUD/JPY | +0.17% | Neutral for UK stocks |

| US 10yr Yield | +11pts | Neutral for UK stocks |

Having formed a bullish reversal candle on Monday, the FTSE put in a strong thrust to the upside during yesterday’s session – closing near highs for the day.

This burst of bullish momentum has the potential to trigger a more substantial rally.

| Final Results |

| Netcall (NET) |

| Interim Results |

| Tesco (TSCO) |

| UK Economic Announcements |

| (09:30) PMI Composite |

| International Economic Announcements |

| (09:00) PMI Services (EU) |

| (09:00) PMI Composite (EU) |

| (13:30) Balance of Trade (US) |

| (14:45) PMI Composite (US) |

| (14:45) PMI Services (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.