4th May 2022. 7.47am

Regency View:

Morning Report – Wednesday 4th May

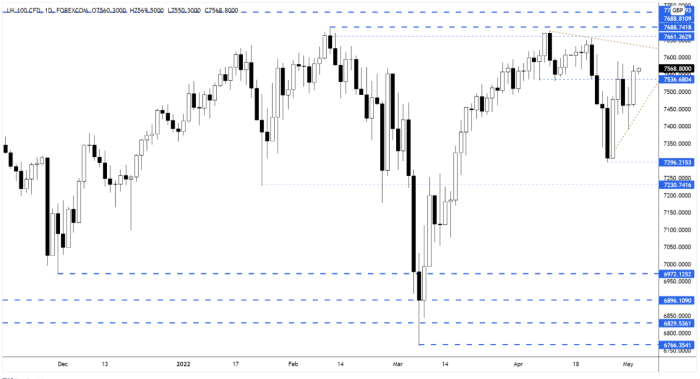

FTSE to open at 7,560 (-1 pt)

US stocks consolidated Monday’s turnaround with the S&P 500 holding above key support.

While overnight, Brent and WTI crude prices have ticked higher after industry data showed drawdowns in US crude and fuel stockpiles, raising supply concerns.

Asian stocks have weakened on the back of strong oil prices and also in anticipation of this evening’s key Fed rate decision and monetary policy statement.

| S&P 500 | +0.48% | Bullish for UK stocks |

| Hang Seng | -1.02% | Bearish for UK stocks |

| Gold | -0.13% | Neutral for UK stocks |

| AUD/JPY | +0.35% | Bullish for UK stocks |

| US 10yr Yield | -17pts | Neutral for UK stocks |

The FTSE broke and close back above the broken support / new resistance area at 7,536 that we’ve been highlighting for the last two weeks.

A short-term structure of lower swing highs and higher swing lows appears to be ‘funneling’ the market within an emerging ‘wedge’ pattern.

| Trading Announcements |

| Direct Line (DLG) |

| International Economic Announcements |

| (9:00) Retail Sales (EUR) |

| (12:15) ADP Employment Change (US) |

| (14:00) ISM Services PMI (US) |

| (18:00) Fed Interest Rate Decision (US) |

| (18:00) Fed’s Monetary Policy Statement (US) |

| (18:30) FOMC Press Conference (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.