3rd Nov 2021. 7.44am

Regency View:

Morning Report – Wednesday 3rd November

FTSE to open at 7,250 (-25 pts)

Wall Street edged to another record close yesterday – posting it’s fourth consecutive day of gains.

All eyes will be on the US Federal Reserve this evening as it is widely expected to begin tapering its $120bn monthly asset purchases…

The taper is priced-in, but what is less certain is how much the Fed will shift their focus towards surging inflation and the possibility of it lasting longer than anticipated. A more hawkish tone would no doubt see US stocks pullback from their record highs.

| S&P 500 | +0.37% | Bullish for UK stocks |

| Hang Seng | -0.52% | Bearish for UK stocks |

| Gold | -0.38% | Bullish for UK stocks |

| AUD/JPY | +0.18% | Neutral for UK stocks |

| US 10yr Yield | -0.81% | Bullish for UK stocks |

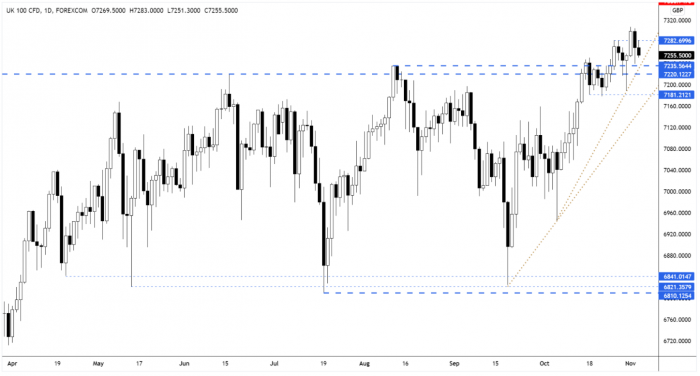

Yesterday’s price action saw the FTSE give back much of Monday’s gains – leaving the market just above broken resistance and the steepest ascending trendline (see chart below).

The FTSE needs to hold above the broken resistance zone in order to rule out the possibility of a bearish ‘fakeout’ scenario.

| Final Results |

| Nanoco (NANO) |

| Interim Results |

| Braemar Shipping (BMS) |

| Esken Ltd (ESKN) |

| Trainline (TRN) |

| Q3 Results |

| Amryt Pharma (AMYT) |

| Trading Announcements |

| Aib Group (AIBG) |

| Coca-Cola HBC (CCH) |

| Ibstock (IBST) |

| Next (NXT) |

| Smurfit Kappa (SKG) |

| UK Economic Announcements |

| (07:00) Nationwide House Price Index |

| International Economic Announcements |

| (09:00) Unemployment Rate (EU) |

| (11:00) MBA Mortgage Applications (US) |

| (14:00) Factory Orders (US) |

| (14:30) Crude Oil Inventories (US) |

| (14:45) PMI Composite (US) |

| (14:45) PMI Services (US) |

| (18:00) Fed Interest Rate Decision |

| (18:00) Fed’s Monetary Policy Statement |

| (18:30) FOMC Press Conference |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.