2nd Mar 2022. 7.35am

Regency View:

Morning Report – Wednesday 2nd March

FTSE to open at 7,336 (+6 pts)

Oil pushed further above $100 while Asian shares sold off as Russia’s invasion of Ukraine intensified…

Brent crude, the international benchmark for oil, surged past $111 a barrel in early trading, with prices now 16% higher since Putin launched his invasion.

Oil’s rally continued despite the US and 30 other countries saying they would release 60 million barrels from their strategic reserves.

In Asian markets, the Hang Seng index broke to a new 18-month low overnight as investors pull money from emerging markets.

| S&P 500 | -1.55% | Bearish for UK stocks |

| Hang Seng | -1.91% | Bearish for UK stocks |

| Gold | -0.19% | Neutral for UK stocks |

| AUD/JPY | +0.17% | Neutral for UK stocks |

| US 10yr Yield | -110pts | Bullish for UK stocks |

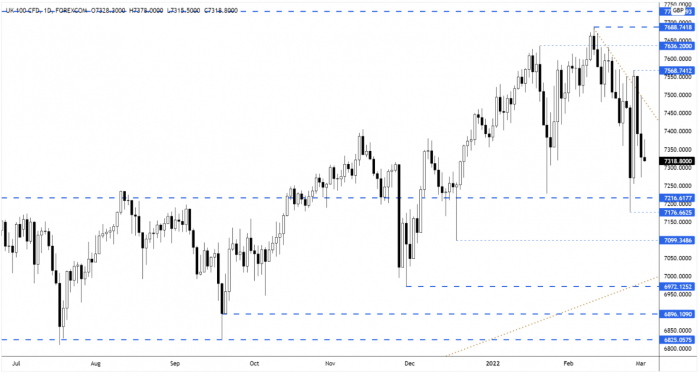

Yesterday’s price action saw the FTSE reject the descending retracement line and close lower on the session – setting up a retest of key support at around 7,200.

| Final Results |

| Aviva (AV.) |

| Nichols (NICL) |

| Vistry Grp (VTY) |

| Persimmon (PSN) |

| Devro (DVO) |

| Polymetal International (POLY) |

| Trustpilot (TRST) |

| Apax Glb (APAX) |

| Hiscox (HSX) |

| Krm22 Plc (KRM) |

| Musicmagpie (MMAG) |

| Interim Results |

| Hotel Choc (HOTC) |

| International Economic Announcements |

| (07:00) Retail Sales (GER) |

| (08:55) Unemployment Rate (GER) |

| (12:00) MBA Mortgage Applications (US) |

| (15:00) ISM Manufacturing (US) |

| (15:00) ISM Prices Paid (US) |

| (15:30) Crude Oil Inventories (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.