2nd Jun 2021. 7.43am

Regency View:

Morning Report – Wednesday 2nd June

FTSE to open at 7,079 (-1 pt)

US stocks remained muted yesterday despite strong gains from European equities and better-than-expected manufacturing data for May.

Overnight in Asia, stocks retreated from three-month highs as the commodities rally continued to ramp up inflationary pressures.

There is a mildly bearish tone to our Risk Barometer this morning, and we’re likely to see a cautious start to European trading.

| S&P 500 | -0.05% | Bearish for UK stocks |

| Hang Seng | -0.68% | Bearish for UK stocks |

| Gold | -0.11% | Neutral for UK stocks |

| AUD/JPY | +0.08% | Neutral for UK stocks |

| US 10yr Yield | +1.82% | Bearish for UK stocks |

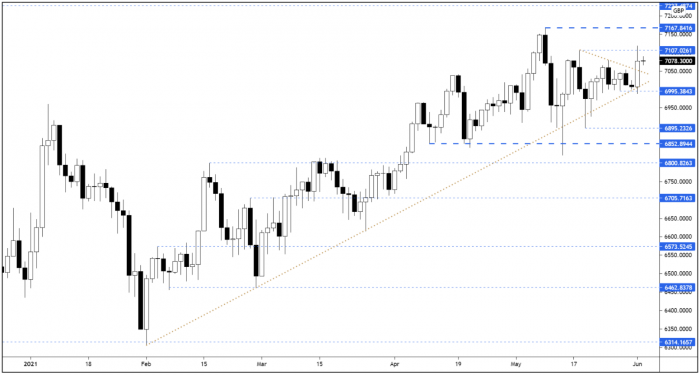

The FTSE finally put in an expansive directional session yesterday – it came in the form of a strong push into swing resistance at 7,107.

This decisive burst of momentum should in theory lead to a retest of the May highs. However, yesterday’s muted reaction on Wall Street has created a bit of a headwind for the market – dampening the FTSE’s bullish momentum.

| Final Results |

| Bloomsbury (BMY) |

| Schroder Real (SREI) |

| Wizz Air (WIZZ) |

| UK Economic Announcements |

| (00:00) M4 Money Supply |

| (00:01) BRC Shop Price Index |

| (09:30) Mortgage Approvals |

| (09:30) Consumer Credit |

| International Economic Announcements |

| (10:00) Producer Price Index (EU) |

| (12:00) MBA Mortgage Applications (US) |

| (15:00) ISM Manufacturing (US) |

| (15:00) ISM Prices Paid (US) |

| (15:30) Crude Oil Inventories (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.