26th May 2021. 7.50am

Regency View:

Morning Report – Wednesday 26th May

FTSE to open at 7,035 (+6 pts)

The US housing data that we’ve seen so far this week has been a mixed bag, which has ultimately seen the US dollar continue to move towards lows for the year…

The S&P/Case-Shiller Home Price Index rose 13.3% year-on-year to March – beating analyst estimates of 11.7%, but month-on-month new home sales for April disappointed at 0.863 million. We still have US mortgage approvals to come today, and US pending home sales on Thursday.

Stocks on Wall Street were lackluster yesterday, putting in a small ‘spinning top’ formation which can be seen as bearish. However, Asian stocks and currencies have had a solid session – taking European equity futures into mildly positive territory.

| S&P 500 | -0.21% | Bearish for UK stocks |

| Hang Seng | +0.72% | Bullish for UK stocks |

| Gold | +0.17% | Bearish for UK stocks |

| AUD/JPY | +0.47% | Bullish for UK stocks |

| US 10yr Yield | -2.85% | Bullish for UK stocks |

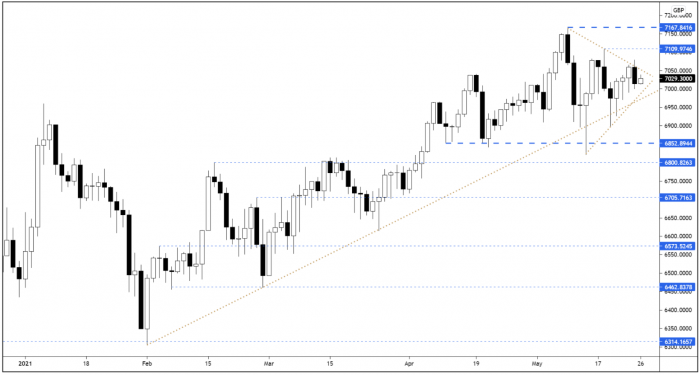

Yesterday’s price action saw the FTSE fail to hold above the top of the wedge, and instead retreat – closing near intra-day days and taking the market back to the bottom of the ever-tightening wedge pattern.

Along with the bottom of the wedge, we also have support from the ascending trendline which has formed since the turn of the year. We’ll be looking for the market to respond to one of these support levels today.

| Final Results |

| Asa Int (ASAI) |

| Biffa (BIFF) |

| De La Rue (DLAR) |

| Marks & Spencer (MKS) |

| Mediclinic International (MDC) |

| SSE (SSE) |

| Interim Results |

| Auction Tech (ATG) |

| Oxford Metrics (OMG) |

| International Economic Announcements |

| (12:00) MBA Mortgage Applications (US) |

| (15:30) Crude Oil Inventories (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.