25th May 2022. 7.47am

Regency View:

Morning Report – Wednesday 25th May

FTSE to open at 7,533 (+49 pts)

The S&P’s two-day relief rally came to an end yesterday as supply chain woes and surging costs hurt corporate earnings and manufacturing output slowed.

Overnight in Asia, its been a quiet session with the Hang Seng and Nikkei 225 both treading water ahead of this evening’s FOMC minutes which should give some clues as to when the current US rate hike cycle may come to an end.

While this morning’s German GDP data came in slightly ahead of expectations with the economy growing 3.8% in Q1 versus 3.7% expected.

| S&P 500 | -0.81% | Bearish for UK stocks |

| Hang Seng | +0.17% | Neutral for UK stocks |

| Gold | -0.47% | Bullish for UK stocks |

| AUD/JPY | +0.16% | Neutral for UK stocks |

| US 10yr Yield | -96pts | Bullish for UK stocks |

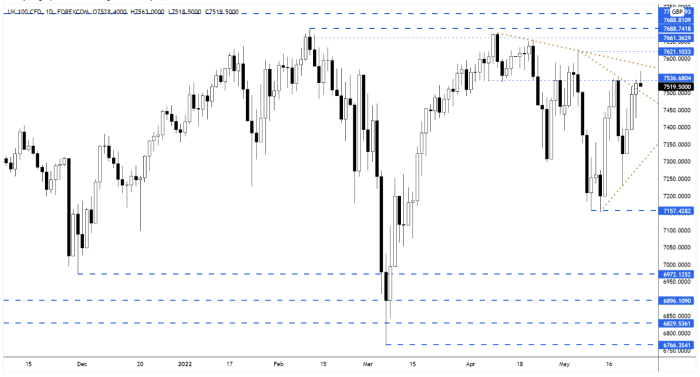

Yesterday’s price action saw the FTSE shake off early losses and push higher into the resistance zone…

We currently have multiple levels of resistance in play and we have seen this morning’s pre-open price action on the FTSE futures reject higher prices.

| Final Results |

| Mediclinic International (MDC) |

| SSE (SSE) |

| Pets At Home (PETS) |

| Marks & Spencer (MKS) |

| Severn Trent (SVT) |

| Braemar Shipping (BMS) |

| Trading Announcements |

| Intertek Group (ITRK) |

| Regional Reit (RGL) |

| International Economic Announcements |

| (06:00) German Gross Domestic Product (YoY)(Q1) (EUR) |

| (08:00) ECB’s President Lagarde speech (EUR) |

| (11:05) BoJ’s Governor Kuroda speech (JPY) |

| (12:30) Durable Goods Orders (Apr) |

| (18:00) FOMC Minutes |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.