23rd Mar 2022. 7.42am

Regency View:

Morning Report – Wednesday 23rd March

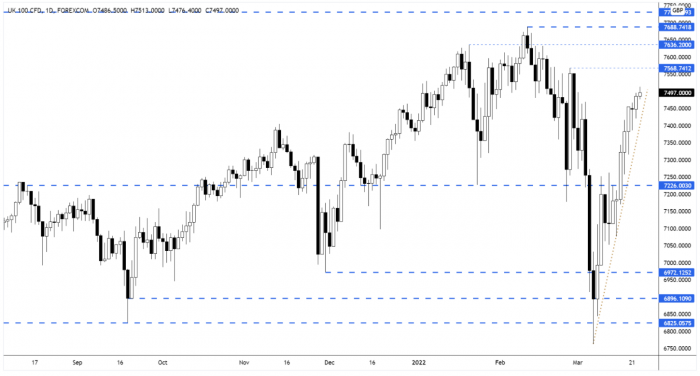

FTSE to open at 7,493 (+16 pts)

Asian equities hit three week highs overnight with beaten-down sectors such as technology making the biggest gains.

While this morning’s UK inflation data hit a new 30-year high, with consumer prices rising by 6.2% in the 12 months to February – as fuel, energy and food costs surged.

The data comes ahead of Chancellor Rishi Sunak’s Spring Statement in which he is expected to cut fuel duty, boost benefits and raise the threshold for national insurance.

| S&P 500 | +1.13% | Bullish for UK stocks |

| Hang Seng | +1.36% | Bullish for UK stocks |

| Gold | -0.09% | Neutral for UK stocks |

| AUD/JPY | +0.08% | Neutral for UK stocks |

| US 10yr Yield | +91pts | Bearish for UK stocks |

The FTSE has continued its steady climb higher although volatility is starting to reduce considerably…

The market printed its second consecutive narrowest range in over seven sessions – indicating that the market is starting to ‘coil’ ahead of another ‘momentum move’.

| Final Results |

| Henry Boot (BOOT) |

| Judges Scientfc (JDG) |

| Pittards (PTD) |

| Dignity (DTY) |

| Krm22 Plc (KRM) |

| Sigmaroc (SRC) |

| Surgical Innovations (SUN) |

| Pendragon (PDG) |

| UK Economic Announcements |

| (07:00) Consumer Price Index (YoY)(Feb) |

| (12:00) Chancellor Rishi Sunak Spring Budget |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.