23rd Jun 2021. 7.48am

Regency View:

Morning Report – Wednesday 23rd June

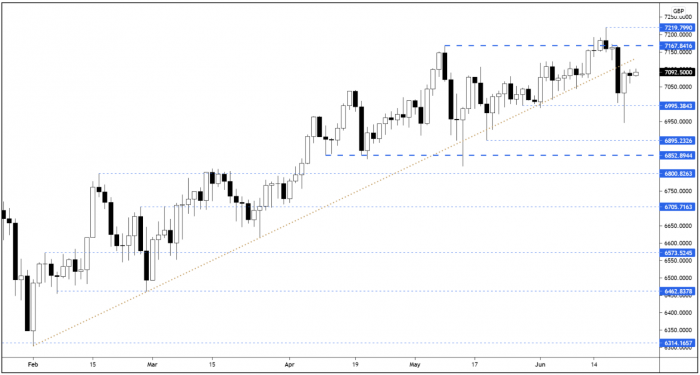

FTSE to open at 7,099 (+9 pts)

Comments from Fed Chair Jerome Powell seemed to calm markets yesterday, ending two consecutive sessions of wild swings.

Speaking before a U.S. House of Representatives panel, Mr Powell said “we will wait for evidence of actual inflation or other imbalances”.

Our Risk Barometer looks bullish as we head into the European open, with gold and bond yields consolidating near short-term lows, and stocks rallying.

| S&P 500 | +0.51% | Bullish for UK stocks |

| Hang Seng | +1.42% | Bullish for UK stocks |

| Gold | +0.11% | Neutral for UK stocks |

| AUD/JPY | +0.22% | Bullish for UK stocks |

| US 10yr Yield | -1.77% | Neutral for UK stocks |

Yesterday’s price action saw the FTSE form a small ‘doji’ candle right on the mid-point between last Wednesday’s high and Monday’s low – indicating that the market is indecisive and in short-term equilibrium.

We are still of the few that a retest of the broken trendline should see selling pressure increase.

| Final Results |

| Berkeley Group (BKG) |

| Liontrust Asset Management (LIO) |

| Manolete Partn. (MANO) |

| Trading Announcements |

| Joules Grp (JOUL) |

| International Economic Announcements |

| (12:00) MBA Mortgage Applications (US) |

| (13:30) Current Account (US) |

| (15:00) New Homes Sales (US) |

| (15:30) Crude Oil Inventories (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.