22nd Dec 2021. 7.46am

Regency View:

Morning Report – Wednesday 22nd December

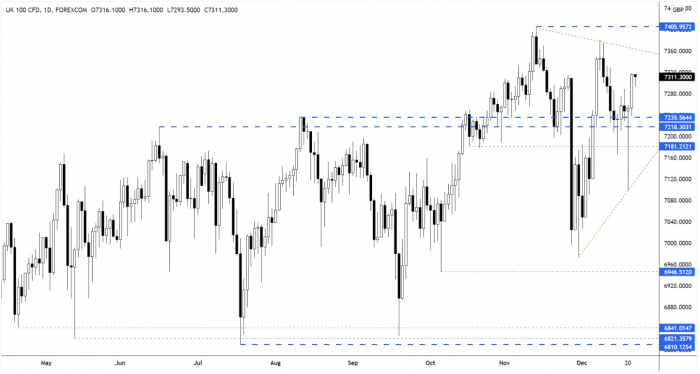

FTSE to open at 7,300 (+3 pts)

Wall Street bounced back yesterday as markets continue to flip flop on the impact Omicron is having on global growth.

It has been a relatively quiet Asian session with the Hang Seng and Nikkei 225 treading water in small positive territory.

This morning’s UK GDP numbers revealed that Britain’s economy grew more slowly than previously thought in the July-September period (+1.1% for Q3).

| S&P 500 | +1.78% | Bullish for UK stocks |

| Hang Seng | +0.30% | Bullish for UK stocks |

| Gold | -0.12% | Neutral for UK stocks |

| AUD/JPY | -0.17% | Neutral for UK stocks |

| US 10yr Yield | +2.46% | Bearish for UK stocks |

The FTSE closed near intra-day highs yesterday as the market posted a strong session following Monday’s bullish reversal candle.

Given the FTSE’s recent swing structure, we could see a large wedge pattern develop (see gold dotted lines on chart below), prices look set test the top of this emerging wedge this week.

| UK Economic Announcements |

| 07:00 Gross Domestic Product (Q3) |

| International Economic Announcements |

| 13:30 US Gross Domestic Product (Q3) |

| (15:00) US Consumer Confidence |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.