21st Sep 2022. 7.44am

Regency View:

Morning Report – Wednesday 21st September

FTSE to open at 7,172 (-19 pts)

Stocks on Wall Street resumed their recent slide yesterday as the yield on US Treasuries continued to march higher.

Asian stocks have mirrored the losses on Wall Street with Hong Kong’s Hang Seng index, Japan’s Topix and China’s CSI 300 all dropping more than -1%.

The market will be closely watching the US Federal Reserve, which is expected to deliver a third consecutive 0.75 percentage point increase in interest rate later today.

| S&P 500 | -1.13% | Bearish for UK stocks |

| Hang Seng | -1.10% | Bearish for UK stocks |

| Gold | +0.54% | Bearish for UK stocks |

| AUD/JPY | -0.18% | Neutral for UK stocks |

| US 10yr Yield | +73pts | Bearish for UK stocks |

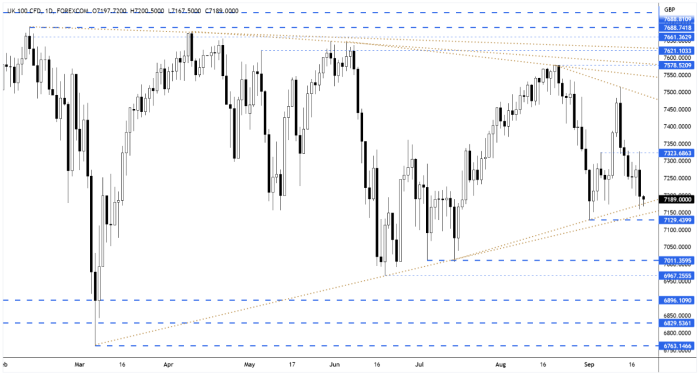

Yesterday’s price action saw the FTSE touch the interim resistance level at 7,323 before reversing to close near the bottom of the long-term wedge.

Whilst there are now multiple support levels to support the market, short-term momentum is firmly bearish.

| Final Results |

| Galliford Try (GFRD) |

| Supermarket Inc (SUPR) |

| Interim Results |

| Lbg Media (LBG) |

| Pennant International (PEN) |

| Keywords Studio (KWS) |

| Mhc Plc (MHC) |

| Alphawave Ip (AWE) |

| Pjsc Polyus S (PLZL) |

| Warpaint London (W7L) |

| M&C Saatchi (SAA) |

| City Pub Group. (CPC) |

| Dianomi (DNM) |

| Ten Ent Grp (TEG) |

| Pendragon (PDG) |

| Monreal (MORE) |

| Ingenta (ING) |

| S4 Cap. (SFOR) |

| UK Economic Announcements |

| (07:00) Public Sector Net Borrowing |

| International Economic Announcements |

| (12:00) MBA Mortgage Applications (US) |

| (15:30) Crude Oil Inventories (US) |

| (15:00) Existing Home Sales (US) |

| (18:00) Fed Interest Rate Decision (US) |

| (18:00) Fed’s Monetary Policy Statement (US) |

| (18:00) FOMC Economic Projections (US) |

| (18:30) FOMC Press Conference (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.