21st Apr 2021. 7.47am

Regency View:

Morning Report – Wednesday 21st April

FTSE to open at 6,882 (+22 pts)

Wall Street posted its first back-to-back losses since March as the S&P retreated from all-time highs following a rise in global COVID-19 cases.

The bearish sentiment has continued into the Asian trading with Hong Kong’s Hang Seng and Japan’s Nikkei down nearly 2% on the session.

European stock futures are positive, but this represents a small bounce following yesterday’s heavy losses.

| S&P 500 | -0.68% | Bearish for UK stocks |

| Hang Seng | -1.83% | Bearish for UK stocks |

| Gold | +0.37% | Neutral for UK stocks |

| AUD/JPY | -0.18% | Neutral for UK stocks |

| US 10yr Yield | +0.45% | Neutral for UK stocks |

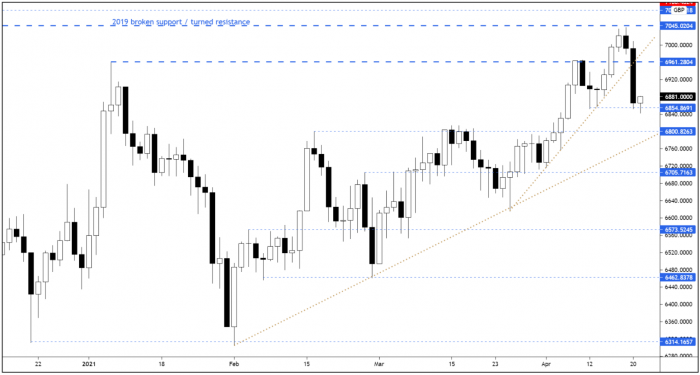

We mentioned in yesterday’s Morning Report that the FTSE needed to hold above the broken resistance area at 6,961 in order to maintain the integrity of the market’s recent uptrend.

The market failed to do so and instead broke decisively below its ascending trendline – changing the short-term momentum dynamic from bullish to bearish.

In terms of support, there is short-term swing low support at 6,854, but given the change in momentum, we’d expect this to break. The next major support for the FTSE comes in at the 6,800 broken resistance / ascending trendline area.

| Final Results |

| Distrib. Fin. (DFCH) |

| Pennant International (PEN) |

| Wentworth Res. (WEN) |

| Interim Results |

| Carrs Group (CARR) |

| Trading Announcements |

| Antofagasta (ANTO) |

| BHP Group (BHP) |

| Quilter (QLT) |

| Rio Tinto (RIO) |

| UK Economic Announcements |

| (07:00) Producer Price Index |

| (07:00) Retail Price Index |

| (07:00) Consumer Price Index |

| International Economic Announcements |

| (12:00) MBA Mortgage Applications (US) |

| (15:30) Crude Oil Inventories (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.