20th Apr 2022. 7.48am

Regency View:

Morning Report – Wednesday 20th April

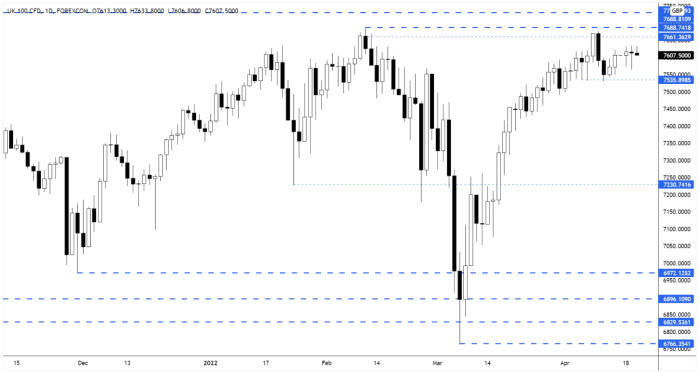

FTSE to open at 7,623 (+22 pts)

Stocks on Wall Street rallied yesterday despite an 80 point surge in 10yr Treasury yields in anticipation of aggressive Fed tightening.

Overnight in Asia, stocks have been mixed with the Hang Seng in negative territory as Covid-19 lockdowns throughout mainland China continue to weigh on growth. While Japanese stocks hit a nine-day high – tracking the gains on Wall Street.

We have a raft of US corporate earnings hitting our screens today with the likes of Kinder Morgan (KMI), Procter & Gamble (PG) and Alcoa Corp (AA) reporting numbers.

| S&P 500 | +1.61% | Bullish for UK stocks |

| Hang Seng | -0.62% | Bearish for UK stocks |

| Gold | -0.52% | Bullish for UK stocks |

| AUD/JPY | +0.42% | Bullish for UK stocks |

| US 10yr Yield | +80pts | Bearish for UK stocks |

We mentioned in yesterday’s Morning Report that the FTSE was in mid-range ‘coin toss’ territory for day traders, and this was underlined by yesterday’s price action which saw the market whipsaw sideways.

On a more bullish note, the market did close well off its intra-day lows – indicating the underlying strength in the market and it wouldn’t be too surprising to see the FTSE break above yesterday’s highs during today’s session.

| Interim Results |

| Carrs Group (CARR) |

| Q1 Results |

| Centamin PLC (CEY) |

| Trading Announcements |

| Antofagasta (ANTO) |

| Rio Tinto (RIO) |

| Bunzl (BNZL) |

| International Economic Announcements |

| (07:00) Producer Price Index (GER) |

| (10:00) Industrial Production (EU) |

| (10:00) Balance of Trade (EU) |

| (12:00) MBA Mortgage Applications (US) |

| (15:00) Existing Home Sales (US) |

| (15:30) Crude Oil Inventories (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.