19th Jan 2022. 7.44am

Regency View:

Morning Report – Wednesday 19th January

FTSE to open at 7,523 (-41 pts)

The bond market continued to dominate the narrative yesterday as US Treasury yields kept climbing with markets pricing-in four rate hikes this year.

On Wall Street, the rise in bond yields saw the ‘tech wreck’ raise its ugly head again with the Nasdaq composite index dropping more than 2%.

Overnight in Asia, stocks have mirrored the sell-off on Wall Street with Australia’s ASX 200 down more than 1% and Japan’s Nikkei 225 breaking to three-month lows.

While this morning’s UK inflation data hit a 30-year high, with the Consumer Price Index rising to 5.4% in December (year-on-year) – exceeding analyst expectations.

| S&P 500 | -1.84% | Bearish for UK stocks |

| Hang Seng | -0.18% | Neutral for UK stocks |

| Gold | -0.01% | Neutral for UK stocks |

| AUD/JPY | -0.13% | Neutral for UK stocks |

| US 10yr Yield | +59pts | Bearish for UK stocks |

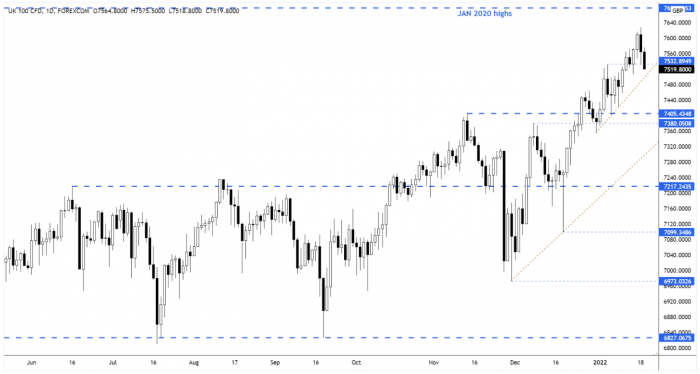

We mentioned in yesterday’s Morning Report that price action had indicated that we may see a retracement and that’s exactly what we got.

How deep the retracement goes remains to be seen, but clear reference levels include the broken 5th Jan swing highs at 7,533 and the ascending trendline.

| Trading Announcements |

| BHP Group (BHP) |

| Wetherspoon (JDW) |

| Antofagasta (ANTO) |

| UK Economic Announcements |

| 07:00 Consumer Price Index (YoY)(Dec) |

| 14:15 BoE’s Governor Bailey speech |

| International Economic Announcements |

| 07:00 (EUR) Harmonized Index of Consumer Prices (YoY)(Dec) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.