17th Aug 2022. 7.46am

Regency View:

Morning Report – Wednesday 17th August

FTSE to open at 7,553 (+17 pts)

Stocks on Wall Street edged higher on Tuesday despite disappointing data on the strength of the US property market.

While overnight in Asia, stocks have had a stronger session with Hong Kong’s Hang Seng gaining +0.77% and Japan’s Nikkei 225 jumping more than 1%.

This morning’s UK inflation data came in higher than expected with the Consumer Price Index hitting 10.1% (year-on-year) in July, it’s highest level in 40 years.

| S&P 500 | +0.19% | Neutral for UK stocks |

| Hang Seng | +0.77% | Bullish for UK stocks |

| Gold | +0.12% | Neutral for UK stocks |

| AUD/JPY | -0.14% | Neutral for UK stocks |

| US 10yr Yield | +15pts | Neutral for UK stocks |

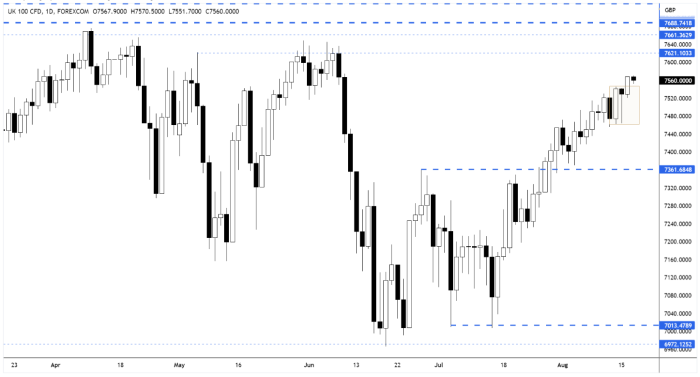

The FTSE continues to climb towards the cluster of key highs at 7,621…

Yesterday’s price action saw the index break and close above the inside bullish pin-bar pattern (gold box on chart below), signalling trend continuation.

| Final Results |

| Libertine Hold (LIB) |

| Interim Results |

| Balfour Beatty (BBY) |

| Persimmon (PSN) |

| Essentra (ESNT) |

| Plus500 (PLUS) |

| Kenmare Resources (KMR) |

| UK Economic Announcements |

| (07:00) Consumer Price Index |

| (07:00) Producer Price Index |

| (07:00) Retail Price Index |

| International Economic Announcements |

| (07:00) Consumer Price Index (GER) |

| (10:00) GDP (Preliminary) (EU) |

| (13:30) Retail Sales (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.