15th Jun 2022. 7.45am

Regency View:

Morning Report – Wednesday 15th June

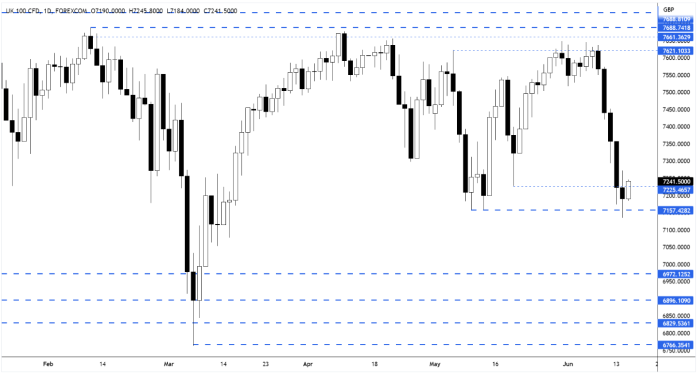

FTSE to open at 7,238 (+51 pts)

The rout on Wall Street slowed yesterday as stocks edged lower ahead of this evening’s Fed rate decision and policy statement.

Overnight in Asia, Chinese retail sales declined for a third consecutive month in May as Beijing’s ‘zero-Covid’ strategy dampened growth.

In Europe, there is growing concerns that the borrowing costs for heavily indebted countries such as Italy and Spain are unsustainable and this may be addressed during ECB President Christine Lagarde’s speech this afternoon.

| S&P 500 | -0.38% | Bearish for UK stocks |

| Hang Seng | +1.39% | Bullish for UK stocks |

| Gold | +0.62% | Bearish for UK stocks |

| AUD/JPY | +0.01% | Neutral for UK stocks |

| US 10yr Yield | +109pts | Bearish for UK stocks |

Yesterday’s price action saw the FTSE respond to key support at 7,157…

The market bounced from support twice, once during mid-day trading and for a second time during after hours trading – forming a small double-bottom reversal pattern on lower time-frames.

| Final Results |

| Ao World (AO.) |

| Q4 Results |

| Ashtead Group (AHT) |

| International Economic Announcements |

| (09:00) European Industrial Production (MoM)(Apr) (EUR) |

| (12:30) US Retail Sales (MoM)(May) (USD) |

| (16:20) ECB’s President Lagarde speech (EUR) |

| (18:00) Fed Interest Rate Decision (USD) |

| (18:00) Fed’s Monetary Policy Statement (USD) |

| (18:00) FOMC Economic Projections (USD) |

| (18:30) FOMC Press Conference (USD) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.