14th Sep 2022. 7.50am

Regency View:

Morning Report – Wednesday 14th September

FTSE to open at 7,342 (-43 pts)

Stocks on Wall Street sank lower yesterday as US inflation data came in ahead o expectations…

The consumer price index increased 0.1% for August, above economists’ expectations for a 0.1% drop.

Core inflation — which strips out volatile items like energy and food — rose by 0.6% for an annual increase of 6.3%, compared with 5.9% recorded for July.

Traders quickly moved to recalibrate the future path of Fed interest rates, and the S&P tumbled more than -4%.

| S&P 500 | -1.13% | Bearish for UK stocks |

| Hang Seng | -1.10% | Bearish for UK stocks |

| Gold | +0.54% | Bearish for UK stocks |

| AUD/JPY | -0.18% | Neutral for UK stocks |

| US 10yr Yield | +73pts | Bearish for UK stocks |

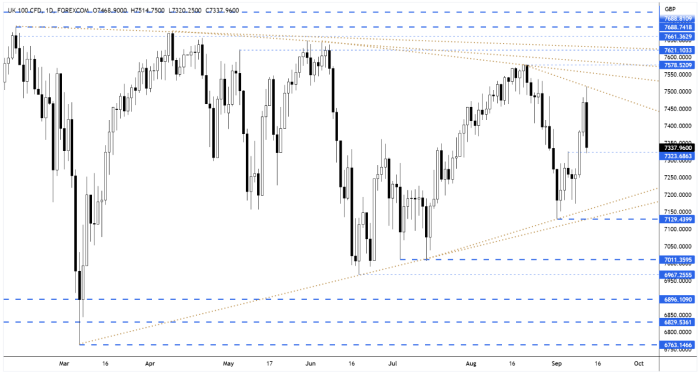

Yesterday’s price action saw the FTSE put in a sharp reversal – forming a bearish engulfing pattern.

The strength of yesterday’s reversal could see the FTSE head lower to retest the bottom of the long-term wedge which appears to be tightening.

| Interim Results |

| Thungela Res (TGA) |

| Mti Wireless (MWE) |

| UK Economic Announcements |

| (00:01) RICS Housing Market Survey |

| International Economic Announcements |

| (07:00) Wholesale Price Index (GER) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.