13th Apr 2022. 7.46am

Regency View:

Morning Report – Wednesday 13th April

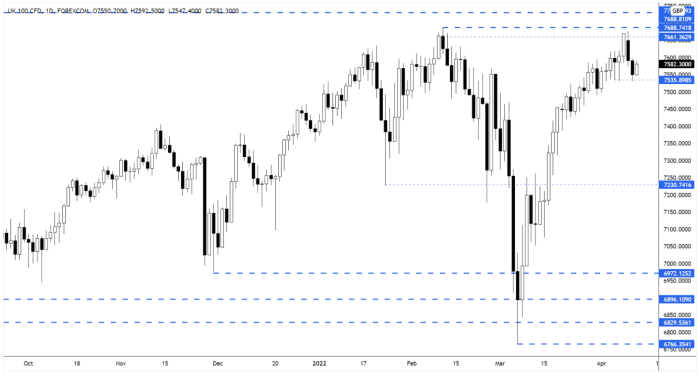

FTSE to open at 7,562 (-15 pts)

Yesterday’s US inflation data showed consumer prices for March had increased by the most in 16 years – as the war in Ukraine caused a spike in energy prices.

However, monthly underlying inflation pressures moderated as US goods prices, excluding food and energy, dropped by the most in two years.

While this morning’s UK inflation data saw consumer prices increase at an annual rate of 7% – a fresh 30-year high, up from 6.2% in February and well above the 0.7% recorded in March 2021.

This inflation rate is more than three-times the BoE’s target and higher than the rate of “around 6%” that it forecast at its last meeting.

| S&P 500 | -0.34% | Bearish for UK stocks |

| Hang Seng | +0.42% | Bullish for UK stocks |

| Gold | +0.05% | Neutral for UK stocks |

| AUD/JPY | +0.32% | Bullish for UK stocks |

| US 10yr Yield | -58pts | Bullish for UK stocks |

The FTSE found support at the 7,535 level that we identified yesterday…

This morning’s price action on the futures has seen the FTSE bounce toward yesterday’s highs.

| Final Results |

| Tesco (TSCO) |

| Lookers (LOOK) |

| Petropavlovsk (POG) |

| Trading Announcements |

| Novolip Regs (NLMK) |

| Pjsc Magni.s (MMK) |

| UK Economic Announcements |

| (07:00) Consumer Price Index |

| (07:00) Producer Price Index |

| (07:00) Retail Price Index |

| International Economic Announcements |

| (13:30) Producer Price Index (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.