10th Nov 2021. 7.45am

Regency View:

Morning Report – Wednesday 10th November

FTSE to open at 7,275 (+1 pt)

Wall Street’s winning run came to an end yesterday as traders grew cautious ahead of today’s US inflation data.

The inflation figures are forecast to show that US consumer prices rose 5.8% in October from the same month last year, representing the highest rate of increases since 1990.

Overnight in Asia, China’s factory gate inflation hit a 26-year high in October due to a sharp rice in coal prices. Stocks are in positive territory despite the increased stagflation concerns.

| S&P 500 | -1.13% | Bearish for UK stocks |

| Hang Seng | -1.10% | Bearish for UK stocks |

| Gold | +0.54% | Bearish for UK stocks |

| AUD/JPY | -0.18% | Neutral for UK stocks |

| US 10yr Yield | +73pts | Bearish for UK stocks |

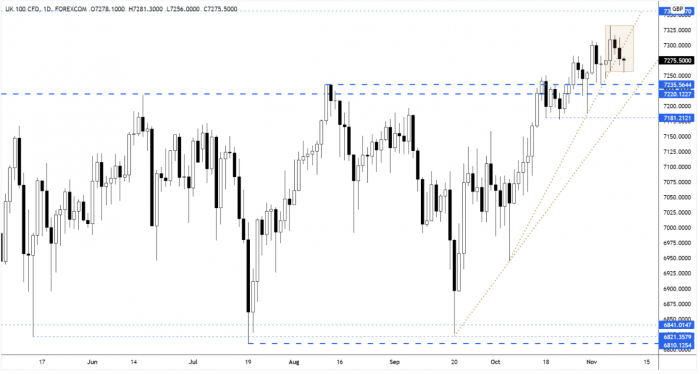

Yesterday’s price action saw the FTSE break below the steepest ascending trendline, but as we highlighted yesterday, the inside day pattern is of most significance and the market remains within Friday’s range (gold box on chart below).

Below Friday’s range, we also have the broken resistance area (blue dotted lines) and the second ascending trendline, so there is plenty of support on the price chart.

| Interim Results |

| Aveva Group (AVV) |

| Marks & Spencer (MKS) |

| Picton Prop (PCTN) |

| Renold (RNO) |

| Zoo Digital (ZOO) |

| Q3 Results |

| Maxcyte (MXCT) |

| International Economic Announcements |

| (07:00) Consumer Price Index (GER) |

| (12:00) MBA Mortgage Applications (US) |

| (13:30) Consumer Price Index (US) |

| (13:30) Initial Jobless Claims (US) |

| (13:30) Continuing Claims (US) |

| (15:00) Wholesales Inventories (US) |

| (15:30) Crude Oil Inventories (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.