10th Mar 2021. 7.49am

Regency View:

Morning Report – Wednesday 10th March

FTSE to open at 6,695 (-35 pts)

It’s been a quiet Asian session with the bond market out of the headlines and the Hang Seng holding above long-term support.

The risk barometer has a bullish to neutral outlook thanks to a solid set of gains in US trading. And whilst the FTSE futures are set for a weak open, this could attract buyers.

| S&P 500 | -1.13% | Bearish for UK stocks |

| Hang Seng | -1.10% | Bearish for UK stocks |

| Gold | +0.54% | Bearish for UK stocks |

| AUD/JPY | -0.18% | Neutral for UK stocks |

| US 10yr Yield | +73pts | Bearish for UK stocks |

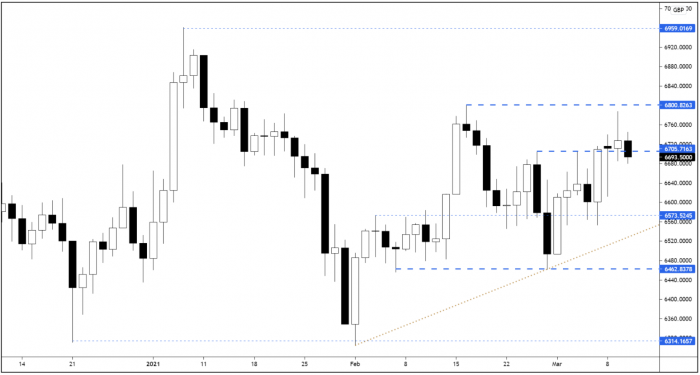

The FTSE came within touching distance of testing the 6,800 February swing highs before beating a hasty retreat.

With the futures languishing near yesterday’s lows, the market will need to hold above the broken swing resistance area at 6,705 to maintain a bullish outlook.

A break of yesterday’s lows in early trading will likely lead to a move down into the 6,600 area.

| Interim Results |

| Thungela Res (TGA) |

| Mti Wireless (MWE) |

| UK Economic Announcements |

| (00:01) RICS Housing Market Survey |

| International Economic Announcements |

| (07:00) Wholesale Price Index (GER) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.