9th Mar 2021. 7.45am

Regency View:

Morning Report – Tuesday 9th March

FTSE to open at 6,694 (-25 pts)

With US bond yields retreating from highs, the inflation fear narrative has cooled and Asian stocks have had a firmer session.

Our risk barometer is in neutral territory, and whilst European equities are set for a mildly bearish open, it wouldn’t be too surprising to see these losses erased within the first hour of trading.

| S&P 500 | -0.54% | Bearish for UK stocks |

| Hang Seng | +0.17% | Neutral for UK stocks |

| Gold | +0.72% | Bearish for UK stocks |

| AUD/JPY | +0.42% | Bullish for UK stocks |

| US 10yr Yield | -3.2% | Bullish for UK stocks |

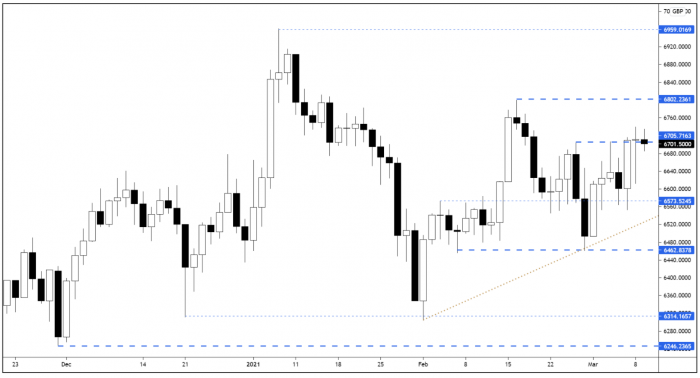

Yesterday’s price action saw the FTSE rally from Friday’s lows to close the session back where it started – near 6,705 swing resistance.

Monday’s rally and yesterday’s intra-day bounce back means we have two consecutive bullish candles in place. Hence a break above yesterday’s highs at 6,740 should trigger a move towards the 6,800 February swing highs.

| Final Results |

| Arix Bioscience (ARIX) |

| Cairn Energy (CNE) |

| Capital & Counties (CAPC) |

| Capital & Regional (CAL) |

| Foresight Solar (FSFL) |

| Forterra (FORT) |

| Gamesys Group (GYS) |

| Gresham (GHT) |

| Headlam (HEAD) |

| IWG (IWG) |

| Lsl Prop (LSL) |

| Marshall Motor (MMH) |

| Midwich Grp (MIDW) |

| RPS Group (RPS) |

| Standard Life Aberdeen (SLA) |

| TP ICAP (TCAP) |

| Ultra Electronics (ULE) |

| Vaalco Energy (EGY) |

| Interim Results |

| Abingdon Healt. (ABDX) |

| Dfs Furn (DFS) |

| Eenergy Group (EAAS) |

| Orchard Funding (ORCH) |

| Q4 Results |

| Vaalco Energy (EGY) |

| Trading Announcements |

| Braemar Shipping (BMS) |

| UK Economic Announcements |

| (00:01) Retail Sales |

| International Economic Announcements |

| (07:00) Balance of Trade (GER) |

| (07:00) Current Account (GER) |

| (10:00) Gross Domestic Product (EU) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.