8th Jun 2021. 7.48am

Regency View:

Morning Report – Tuesday 8th June

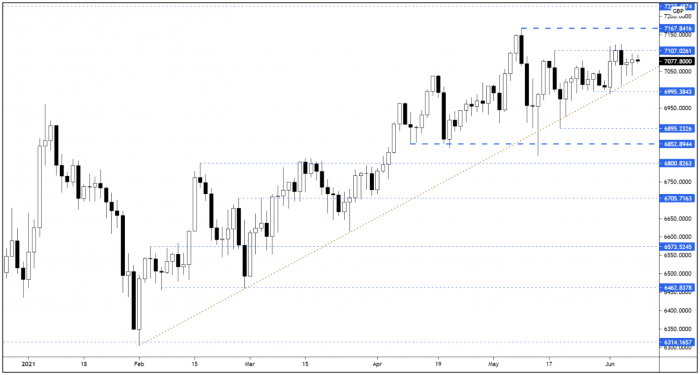

FTSE to open at 7,076 (-1 pt)

The S&P 500 coiled beneath all-time highs yesterday as the market waits for a catalyst to kick-start a new trend leg higher.

Overnight in Asia, stocks gave up early gains as traders remain cautious ahead of US inflation data and European monetary policy statements later this week.

Our Risk Barometer is neutral territory as we head into European trading.

| S&P 500 | -0.08% | Neutral for UK stocks |

| Hang Seng | -0.29% | Bearish for UK stocks |

| Gold | -0.11% | Neutral for UK stocks |

| AUD/JPY | +0.13% | Neutral for UK stocks |

| US 10yr Yield | -2.69% | Bullish for UK stocks |

Another indecisive session from the FTSE yesterday leaves us in the same place we started the week – long-term uptrend remains, but with the absence of short-term directional bias.

| Final Results |

| B.p Marsh (BPM) |

| Intermediate Capital (ICP) |

| Onthemarket (OTMP) |

| Tinybuild Inc S (TBLD) |

| Vp (VP.) |

| Interim Results |

| Driver Grp (DRV) |

| Paragon Group (PAG) |

| Rws Hldgs (RWS) |

| Q3 Results |

| Ferguson (FERG) |

| Trading Announcements |

| British American Tobacco (BATS) |

| UK Economic Announcements |

| (00:01) Retail Sales |

| International Economic Announcements |

| (07:00) Industrial Production (GER) |

| (10:00) ZEW Survey (GER) – Current Situation |

| (10:00) ZEW Survey (GER) – Economic Sentiment |

| (10:00) Gross Domestic Product (EU) |

| (10:00) ZEW Survey (EU) – Economic Sentiment |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.