6th Apr 2021. 7.43am

Regency View:

Morning Report – Tuesday 6th April

FTSE to open at 6,794 (+57 pts)

US stocks broke to new highs yesterday after data showed activity in America’s services sector accelerated at the fastest pace on record in March.

The ISM Services PMI, a closely tracked proxy for economic output, rose to 63.7 in March from 55.3 the month before – with the market expecting 59.

Asian stocks have followed the US higher – posting solid gains and setting a bullish tone to the start of European trading.

| S&P 500 | +1.44% | Bullish for UK stocks |

| Hang Seng | +1.97% | Bullish for UK stocks |

| Gold | +0.43% | Neutral for UK stocks |

| AUD/JPY | +0.11% | Neutral for UK stocks |

| US 10yr Yield | -0.63% | Neutral for UK stocks |

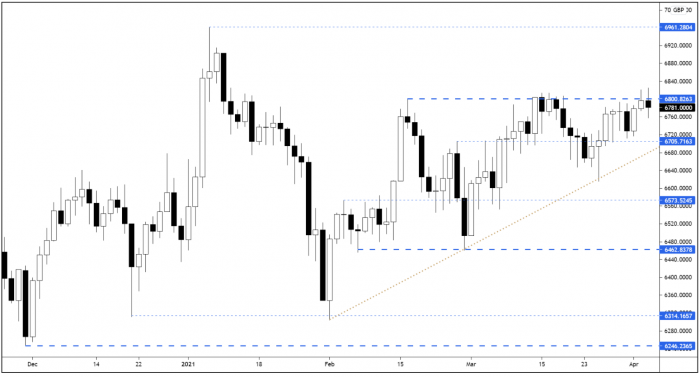

With the cash market closed yesterday, the FTSE futures attempted to broke above key resistance at 6,800, but this breakout could not be maintained and the prices closed back below resistance.

We’ve seen the same false breakout price action overnight and today will prove pivotal in determining whether the 6,800 barrier can finally be broken.

| International Economic Announcements |

| (08:55) PMI Composite (GER) |

| (08:55) PMI Services (GER) |

| (09:00) PMI Composite (EU) |

| (09:00) PMI Services (EU) |

| (10:00) Unemployment Rate (EU) |

| (10:00) Retail Sales (EU) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.