4th Oct 2022. 7.44am

Regency View:

Morning Report – Tuesday 4th October

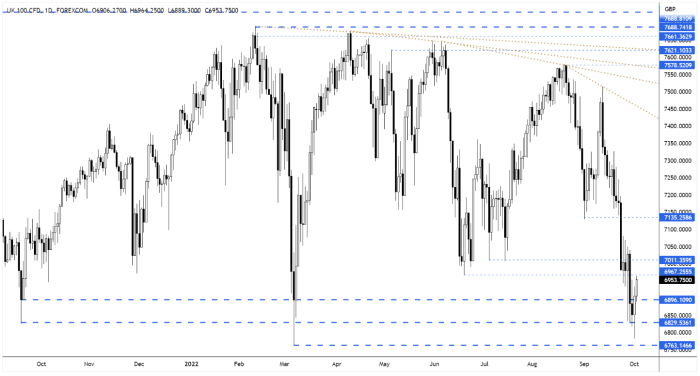

FTSE to open at 6,958 (+49 pts)

US stocks posted strong gains yesterday as the yield on treasuries dropped back from highs…

The S&P 500 closed up 2.6%, while the technology-heavy Nasdaq Composite added 2.3%. Both indices recorded their biggest daily increases since August.

In commodities, Brent crude jumped 4.4% to $88.86 a barrel, helped by news that the international producers’ alliance Opec+ was planning a substantial cut in output.

Overnight in Asia, the Hang Seng is closed for the Double Ninth festival while Japanese stocks mirrored the gains on Wall Street.

| S&P 500 | +2.59% | Bullish for UK stocks |

| Hang Seng | Closed | Neutral for UK stocks |

| Gold | +0.24% | Neutral for UK stocks |

| AUD/JPY | +0.11% | Neutral for UK stocks |

| US 10yr Yield | -165pts | Bullish for UK stocks |

Yesterday’s price action saw the FTSE daily rolling futures form a bullish reversal candle as buyers stepped in at support.

This morning’s pre-open price action has already broken above yesterday’s highs and this is a bullish sign.

| Interim Results |

| Inspiration Hlt (IHC) |

| Trading Announcements |

| Mondi (MNDI) |

| Greggs (GRG) |

| International Economic Announcements |

| (10:00) Producer Price Index (EU) |

| (15:00) Factory Orders (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.