30th Aug 2022. 7.45am

Regency View:

Morning Report – Tuesday 30th August

FTSE to open at 7,410 (+17 pts)

Global stocks weakened and Treasury yields climbed on Monday after central bankers warned of a sustained period of higher interest rates.

Overnight in Asia stocks have been mixed with Hong Kong’s Hang Seng dropping back towards last week’s lows and the Nikkei 225 erasing yesterday’s losses by closing more than 1% higher.

Looking ahead at key economic data this week, we have European and US consumer confidence figures today and US nonfarm payrolls on Friday.

| S&P 500 | -0.67% | Bearish for UK stocks |

| Hang Seng | -0.51% | Bearish for UK stocks |

| Gold | -0.23% | Bullish for UK stocks |

| AUD/JPY | -0.10% | Neutral for UK stocks |

| US 10yr Yield | +63pts | Bearish for UK stocks |

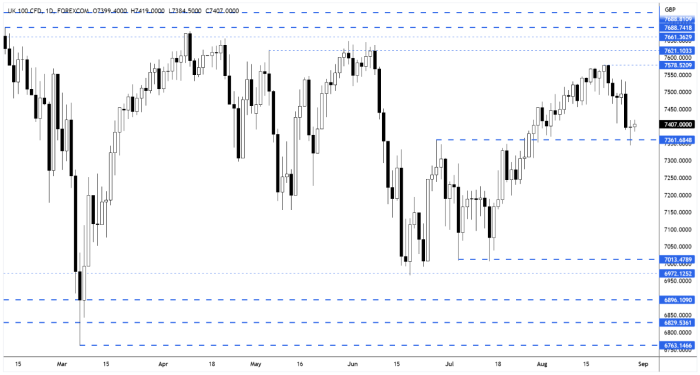

Yesterday’s Bank Holiday price action on the FTSE daily rolling futures saw the market retest the support area at 7,361…

After initially breaking below it, the market rallied back to print a small bullish hammer candle at the support zone.

| Interim Results |

| Centralnic (CNIC) |

| Uniphar Plc (UPR) |

| Old Mutual Lim. (OMU) |

| UK Economic Announcements |

| (09:30) M4 Money Supply |

| (09:30) Mortgage Approvals |

| (09:30) Consumer Credit |

| International Economic Announcements |

| (10:00) Consumer Confidence (EU) |

| (10:00) Economic Sentiment Indicator (EU) |

| (10:00) Industrial Production (EU) |

| (10:00) Business Climate Indicator (EU) |

| (13:00) Consumer Price Index (GER) |

| (14:00) House Price Index (US) |

| (15:00) Consumer Confidence (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.