29th Jun 2021. 7.46am

Regency View:

Morning Report – Tuesday 29th June

FTSE to open at 7,076 (+3 pts)

There seems to be a bit of a disconnect this week between Wall Street and the rest of the world…

While U.S. stocks edged to another record high yesterday, European stocks moved lower on central bank tapering risk, and Asia stocks continued to sink on COVID-19 Delta variant concerns.

This mixed picture is reflected in our Risk Barometer and European futures are broadly flat as we head towards the opening bell.

| S&P 500 | +0.23% | Bullish for UK stocks |

| Hang Seng | -0.93% | Bearish for UK stocks |

| Gold | +0.06% | Neutral for UK stocks |

| AUD/JPY | -0.02% | Neutral for UK stocks |

| US 10yr Yield | -2.54% | Bullish for UK stocks |

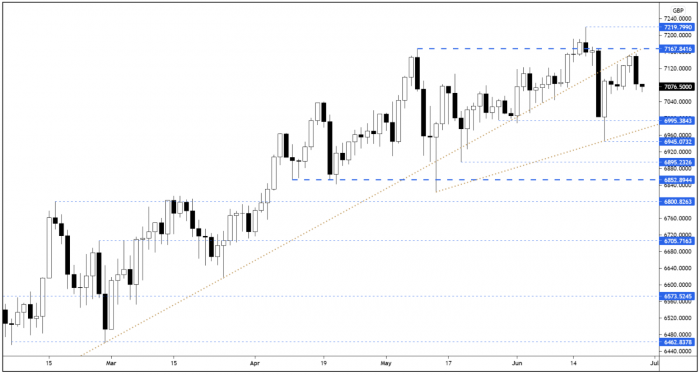

The FTSE sank lower yesterday after retesting the May swing high resistance area that we’ve highlighted in previous Morning Reports.

With short-term momentum moving back in line with the 200 point sell-off we witnessed on 18th June, the logical next step for the FTSE is a retest of the support zone at 7,000 – 6,941.

| Final Results |

| Appreciate Grp. (APP) |

| D4t4 Solutions (D4T4) |

| Lamprell (LAM) |

| Lookers (LOOK) |

| Seeen (SEEN) |

| Trakm8 Hldgs (TRAK) |

| Interim Results |

| React Group (REAT) |

| Trading Announcements |

| Hunting (HTG) |

| UK Economic Announcements |

| (09:30) Mortgage Approvals |

| (09:30) Consumer Credit |

| (09:30) M4 Money Supply |

| International Economic Announcements |

| (10:00) Consumer Confidence (EU) |

| (14:00) House Price Index (US) |

| (15:00) Consumer Confidence (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.