26th Jul 2022. 7.46am

Regency View:

Morning Report – Tuesday 26th July

FTSE to open at 7,316 (+10 pts)

Stocks on Wall Street delivered a mixed performance yesterday ahead of a big week for Big Tech earnings and a crucial interest rate decision from the Fed.

While stocks in Hong Kong have rallied as traders continue to digest news of China’s $44bn fund to prop up its struggling property developers.

In Europe, Russia said it will cut gas supplies from Wednesday in a blow to European countries that have backed Ukraine. And missile attacks in Black Sea coastal regions have raised doubts about whether Russia will stick to a deal to let Ukraine export grain.

An extraordinary meeting of European energy ministers will take place in Brussels today.

| S&P 500 | +0.13% | Bearish for UK stocks |

| Hang Seng | +1.64% | Bearish for UK stocks |

| Gold | +0.19% | Neutral for UK stocks |

| AUD/JPY | +0.17% | Bullish for UK stocks |

| US 10yr Yield | +13pts | Bearish for UK stocks |

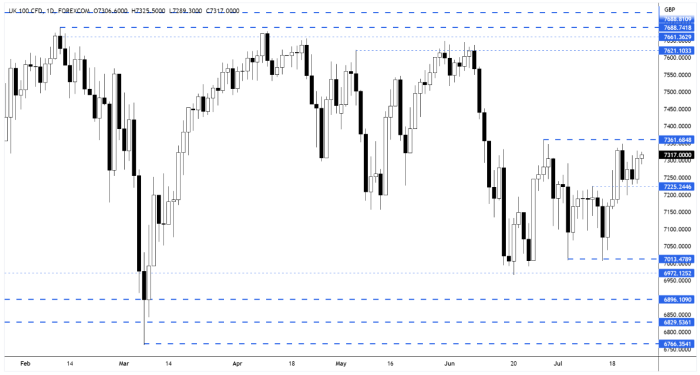

Yesterday’s price action saw the FTSE push higher – taking the index back towards key resistance at 7,361 created by the June swing highs. We’ll be watching closely to see if today’s price action will retest this resistance area.

| Final Results |

| Trifast (TRI) |

| Games Workshop (GAW) |

| Gore Street En. (GSF) |

| Interim Results |

| Unilever (ULVR) |

| Franchise Brand (FRAN) |

| Gresham (GHT) |

| Trading Announcements |

| Compass Group (CPG) |

| Greencore (GNC) |

| Medica Group P. (MGP) |

| International Economic Announcements |

| (14:00) House Price Index (US) |

| (15:00) New Homes Sales (US) |

| (15:00) Consumer Confidence (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.