26th Apr 2022. 7.48am

Regency View:

Morning Report – Tuesday 26th April

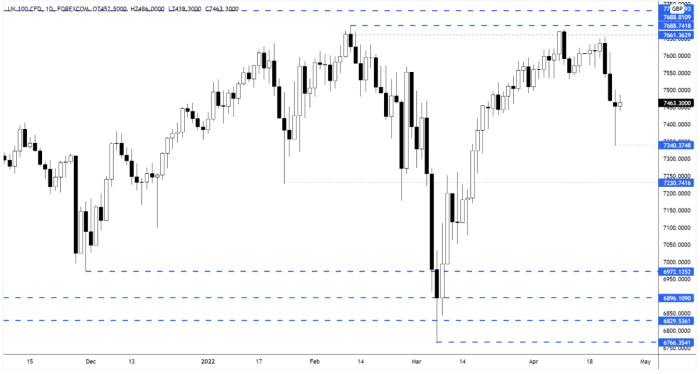

FTSE to open at 7,460 (+79 pts)

Stocks on Wall Street stabilised yesterday after two consecutive sessions of heavy losses…

The S&P 500 put in late afternoon rally as Treasury yields dropped back from recent highs – representing a pause in traders concerns over the impact of aggressive monetary tightening from the Fed.

While overnight, Asian stocks have also strengthened, with tech stocks boosted by news of Elon Musk’s $44bn takeover of Twitter.

| S&P 500 | +0.57% | Bullish for UK stocks |

| Hang Seng | +0.45% | Bullish for UK stocks |

| Gold | +0.27% | Bearish for UK stocks |

| AUD/JPY | +0.28% | Bullish for UK stocks |

| US 10yr Yield | -42pts | Bullish for UK stocks |

Yesterday’s price action saw the FTSE fight back from early-session lows to form a long-tailed ‘pin-bar’ candle.

Whilst this candle in isolation does not necessarily mark a new inflection point, it does provide traders with a short-term ‘line in the sand’ from which to monitor a potential recovery.

| Interim Results |

| AB Foods (ABF) |

| Focusrite (TUNE) |

| Trading Announcements |

| IWG (IWG) |

| Taylor Wimpey (TW.) |

| Jupiter Fund Management (JUP) |

| Flutter Ent (FLTR) |

| International Economic Announcements |

| (12:30) Durable Goods (US) |

| (12:30) Nondefense Capital Goods Orders (US) |

| (13:00) Housing Price Index (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.