25th Jan 2022. 7.45am

Regency View:

Morning Report – Tuesday 25th January

FTSE to open at 7,344 (+47 pts)

Buyers finally stepped in on Wall Street, helping stocks to reverse heavy losses during yesterday’s session…

Having undergone an 11% correction from its 4th Jan highs, yesterday’s price action on the S&P 500 saw the index form a large bullish hammer candle at a key support level created by the September swing lows.

The move came after NATO said it was putting forces on standby and reinforcing eastern Europe with more ships and fighter jets in response to Russia’s military build-up at Ukraine’s borders.

While overnight in Asia, stocks have continued to weaken with the Hang Seng and Nikkei down more than -1% on the day.

| S&P 500 | +0.28% | Bullish for UK stocks |

| Hang Seng | -2.56% | Bearish for UK stocks |

| Gold | -0.03% | Neutral for UK stocks |

| AUD/JPY | -0.23% | Bearish for UK stocks |

| US 10yr Yield | -8pts | Neutral for UK stocks |

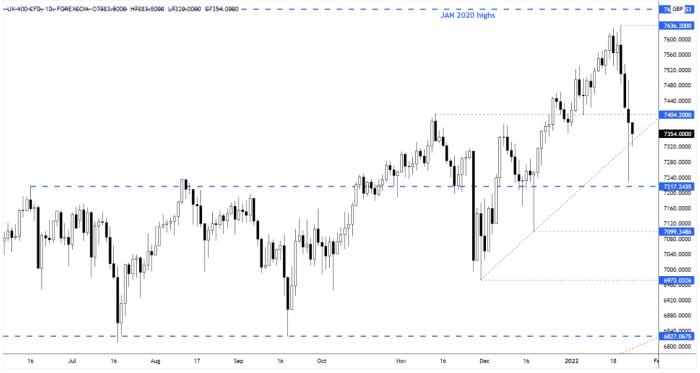

Yesterday marked the largest daily range on the FTSE futures since the ‘Omicron drop’ in late November…

Volatility has increased significantly and the market has erased all of its New Year rally.

Price are now trading back at the trending created by the series of higher swing lows which formed in November and December.

| Trading Announcements |

| TI Fluid Systems (TIFS) |

| Cairn Energy (CNE) |

| International Economic Announcements |

| (14:00) House Price Index (US) |

| (09:00) IFO Current Assessment (GER) |

| (09:00) IFO Expectations (GER) |

| (15:00) Consumer Confidence (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.