22nd Jun 2021. 7.48am

Regency View:

Morning Report – Tuesday 22nd June

FTSE to open at 7,079 (+17 pts)

Wall Street bounced back with gusto yesterday, erasing all of Friday’s losses and putting the S&P back within touching distance of all-time highs.

Overnight, Japanese stocks posted there biggest gains in over a year – boosted by shipping stocks after Mitsui OSK Lines more than tripled its Half-Year net profit forecast. However, this exuberance could not be seen in Chinese-related stocks with Hong Kong’s Hange Seng in negative territory.

| S&P 500 | +1.40% | Bullish for UK stocks |

| Hang Seng | -0.17% | Bearish for UK stocks |

| Gold | +0.06% | Neutral for UK stocks |

| AUD/JPY | -0.16% | Bearish for UK stocks |

| US 10yr Yield | +4.01% | Bullish for UK stocks |

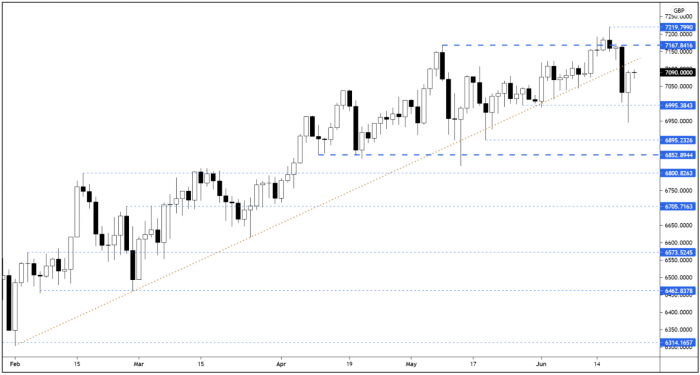

The FTSE put in a sharp intra-day reversal yesterday – rallying from lows and forming a bullish long-tailed candle.

While yesterday’s price action was bullish, momentum is still damaged from Friday’s sell-off. One scenario that could play out is a retest of the broken trendline, or a retest of resistance at 7,167. Either way, we are likely to selling pressure increase the closer we get to resistance.

| Final Results |

| Gear4music (G4M) |

| Novacyt (NCYT) |

| Smith (DS) (SMDS) |

| Staffline (STAF) |

| Trackwise Desi. (TWD) |

| Trifast (TRI) |

| UK Economic Announcements |

| (07:00) Public Sector Net Borrowing |

| International Economic Announcements |

| (15:00) Existing Home Sales (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.