18th Jan 2022. 7.39am

Regency View:

Morning Report – Tuesday 18th January

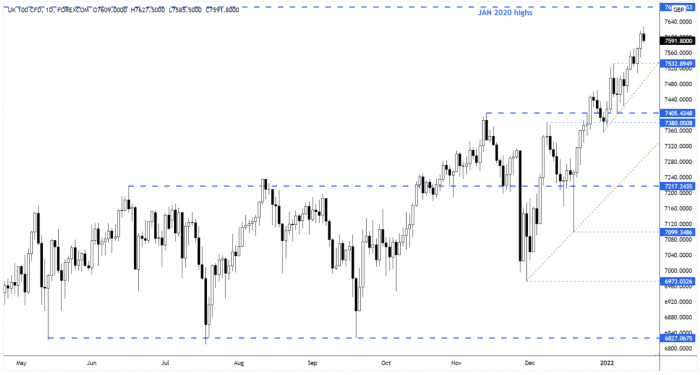

FTSE to open at 7,598 (-13 pts)

Asian stocks have weakened overnight as U.S. Treasury yields hit their highest level in almost two years with investors weighing the risks of a Fed policy rate rise as soon as March.

While oil hit seven-year highs overnight over concerns about supply shocks after Yemen’s Houthi group attacked the United Arab Emirates.

Brent crude, the international benchmark for oil broke past the $86.68 highs reached in October 2018 and November 2021 – adding further pressure to the inflationary backdrop.

| S&P 500 (futures) | -0.19% | Neutral for UK stocks |

| Hang Seng | -0.83% | Bearish for UK stocks |

| Gold | -0.23% | Bullish for UK stocks |

| AUD/JPY | +0.06% | Neutral for UK stocks |

| US 10yr Yield | +45pts | Bearish for UK stocks |

The FTSE continued on its upward trajectory yesterday, closing near its intra-day highs.

Price action on the futures overnight has seen a mild rejection of higher prices and this may set the tone for a retracement day.

| Trading Announcements |

| Hays (HAS) |

| UK Economic Announcements |

| 07:00 Claimant Count Change (Dec) |

| 07:00 ILO Unemployment Rate (3M)(Nov) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.