16th Mar 2021. 7.44am

Regency View:

Morning Report – Tuesday 16th March

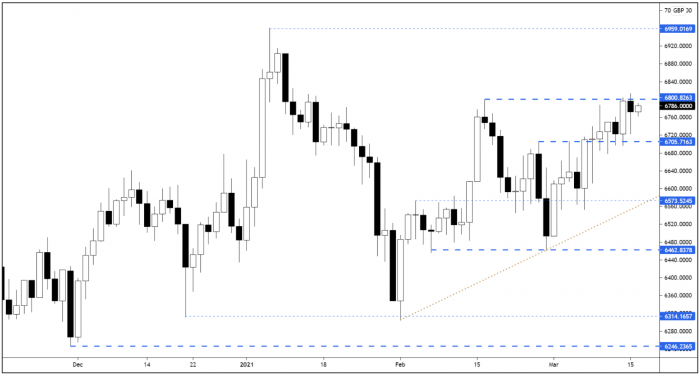

FTSE to open at 6,789 (+44 pts)

US stocks hit record highs yesterday with the S&P breaking above February highs, albeit in relatively cautious fashion.

While Asian stocks remain well below their February highs, the Hang Seng and other major indices in the region have had a mildly bullish session.

There is a feeling that equity markets are waiting for Wednesday’s Federal Reserve meeting to see how Chairman Jay Powell plans to tackle the rise in bond yields.

| S&P 500 | +0.65% | Bullish for UK stocks |

| Hang Seng | +0.75% | Bullish for UK stocks |

| Gold | -0.22% | Neutral for UK stocks |

| AUD/JPY | -0.16% | Neutral for UK stocks |

| US 10yr Yield | +0.01% | Neutral for UK stocks |

The FTSE held below 6,800 resistance during yesterday’s session and dropped back towards Friday’s lows. This drop attracted buyers during the later half of US trading, and the FTSE futures are now back where they started the week, just below 6,800 resistance.

A break above yesterday’s highs during the opening rotation would be a very bullish sign and likely setup the market for a strong day. However, if we swiftly reject 6,800 in early trading, this would create an attractive short opportunity with stops above yesterday’s high.

| Final Results |

| 4Imprint (FOUR) |

| Antofagasta (ANTO) |

| Bakkavor (BAKK) |

| Bango (BGO) |

| Biopharma Cred. (BPCR) |

| Boku Inc. (BOKU) |

| Close Bros (CBG) |

| Computacenter (CCC) |

| Costain (COST) |

| Fintel (FNTL) |

| Greggs (GRG) |

| Harworth Gp (HWG) |

| Kazatomprom (KAP) |

| Krm22 Plc (KRM) |

| Polypipe (PLP) |

| Sabre Insur (SBRE) |

| Stvg (STVG) |

| Team17 Group (TM17) |

| Unite (UTG) |

| Wood Group (WG.) |

| Interim Results |

| Ferguson (FERG) |

| Litigation Cap. (LIT) |

| Scs Group (SCS) |

| Trading Announcements |

| C&c Grp (CCR) |

| International Economic Announcements |

| (07:00) Wholesale Price Index (GER) |

| (10:00) ZEW Survey (GER) – Economic Sentiment |

| (10:00) ZEW Survey (EU) – Economic Sentiment |

| (10:00) ZEW Survey (GER) – Current Situation |

| (12:30) Import and Export Price Indices (US) |

| (12:30) Retail Sales Less Autos (US) |

| (12:30) Retail Sales (US) |

| (13:15) Capacity Utilisation (US) |

| (13:15) Industrial Production (US) |

| (14:00) Business Inventories (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.