15th Mar 2022. 7.46am

Regency View:

Morning Report – Tuesday 15th March

FTSE to open at 7,120 (-73 pts)

US government bond yields rose to multiyear highs on Monday in anticipation of the first rate hike from the Fed in four years…

After the ECB’s hawkish comments last week, traders expect the Fed to follow suit on Wednesday – causing the US 10-yr government bond yield to break to levels not seen since 2018.

While overnight in Asia, the Hang Seng’s sell-off has continued to accelerate with the index dropping another -5%.

| S&P 500 | -0.64% | Bearish for UK stocks |

| Hang Seng | -5.37% | Bearish for UK stocks |

| Gold | -0.87% | Bullish for UK stocks |

| AUD/JPY | -0.19% | Neutral for UK stocks |

| US 10yr Yield | +88pts | Bearish for UK stocks |

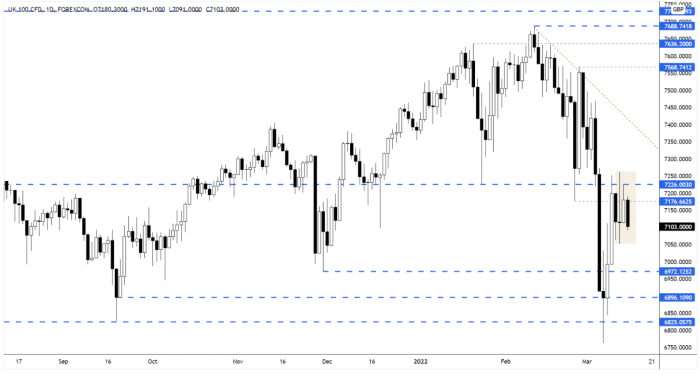

Yesterday’s price action saw the FTSE tread water within Friday’s range – forming an ‘inside day’ pattern just below resistance.

In early trading, the futures have erased yesterday’s gains, but the market remains within the parameters of the inside day.

Should the FTSE break decisively below Friday’s lows at 7,047, this may open the door for a retest of the recent swing lows.

| Annual Report |

| Phoenix Group Holdings (PHNX) |

| Senior (SNR) |

| Literacy Cap (BOOK) |

| SIG (SHI) |

| Aston Martin Lagonda (AML) |

| Angus Energy (ANGS) |

| Jpmorgan Clav (JCH) |

| Wisdom Marine (WML) |

| Final Results |

| Stelrad Grp (SRAD) |

| Phoenix Group Holdings (PHNX) |

| Monreal (MORE) |

| Bodycote (BOY) |

| Literacy Cap (BOOK) |

| Angus Energy (ANGS) |

| Jpmorgan Clav (JCH) |

| Wisdom Marine (WML) |

| Interim Results |

| Fonix Mob. (FNX) |

| Craneware (CRW) |

| Nightcap (NGHT) |

| Mid Wynd International Investment Trust (MWY) |

| Artemis Res (ARV) |

| Mc Mining (MCM) |

| UK Economic Announcements |

| (07:00) ILO Unemployment Rate (3M)(Jan) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.