15th Jun 2021. 7.47am

Regency View:

Morning Report – Tuesday 15th June

FTSE to open at 7,180 (+34 pts)

The S&P staged a late rally to erase earlier losses and close at record highs as traders expect the US Federal Reserve to upgrade its economic outlook at this week’s meeting.

Overnight, Asian stocks have been mixed with Japan’s Nikkei 225 rallying more than 1%, but Hong Kong’s Hang Seng dropping back to two-week lows.

Our Risk Barometer paints a mixed picture, but European futures are higher following Wall Street’s late fightback.

| S&P 500 | +0.18% | Bullish for UK stocks |

| Hang Seng | -0.71% | Bearish for UK stocks |

| Gold | +0.03% | Neutral for UK stocks |

| AUD/JPY | +0.07% | Neutral for UK stocks |

| US 10yr Yield | +3.21% | Bearish for UK stocks |

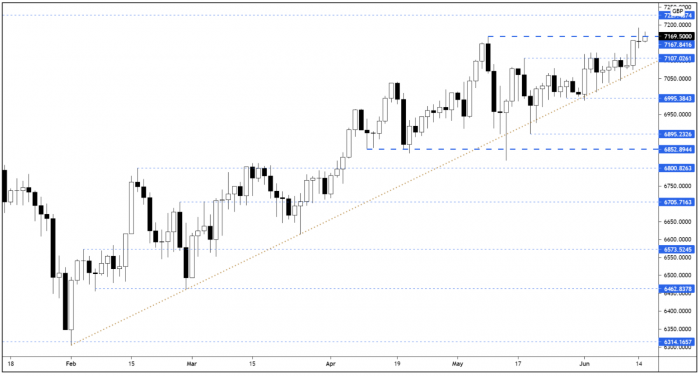

The FTSE failed to hold above the March swing highs during yesterday’s session – closing back below resistance and forming a small bearish pin-bar in the process.

This small reversal candle isn’t hugely significant due to its size, and with today’s futures prices already moving back above resistance, the FTSE will get a second chance to hold above the March highs.

| Final Results |

| Anemoi Interna. (AMOI) |

| CML Microcircuits (CML) |

| Iomart (IOM) |

| Tatton Asset M. (TAM) |

| Thalassa (Di) (THAL) |

| Tp Grp (TPG) |

| Vianet Grp (VNET) |

| Interim Results |

| On The Beach (OTB) |

| Oxford Biodyn (OBD) |

| Pressure Tech (PRES) |

| Ramsdens Hldgs (RFX) |

| Q3 Results |

| Renalytix Ai (RENX) |

| Q4 Results |

| Ashtead Group (AHT) |

| UK Economic Announcements |

| (07:00) Unemployment Rate |

| (07:00) Claimant Count Rate |

| International Economic Announcements |

| (07:00) Consumer Price Index (GER) |

| (10:00) Balance of Trade (EU) |

| (13:30) Retail Sales (US) |

| (13:30) Producer Price Index (US) |

| (14:15) Capacity Utilisation (US) |

| (14:15) Industrial Production (US) |

| (15:00) Business Inventories (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.