15th Feb 2022. 7.44am

Regency View:

Morning Report – Tuesday 15th February

FTSE to open at 7,505 (-27 pts)

Gold has rallied to an eight-month high in recent sessions as risk aversion continues to increase due to escalating Russia / Ukraine tensions.

This heightened risk aversion has created a bearish sweep on our Risk Barometer (below) with Asian stocks continuing to weaken and US government bond yields rallying.

| S&P 500 | -0.38% | Bearish for UK stocks |

| Hang Seng | -0.97% | Bearish for UK stocks |

| Gold | +0.30% | Bearish for UK stocks |

| AUD/JPY | -0.35% | Bearish for UK stocks |

| US 10yr Yield | +54pts | Bearish for UK stocks |

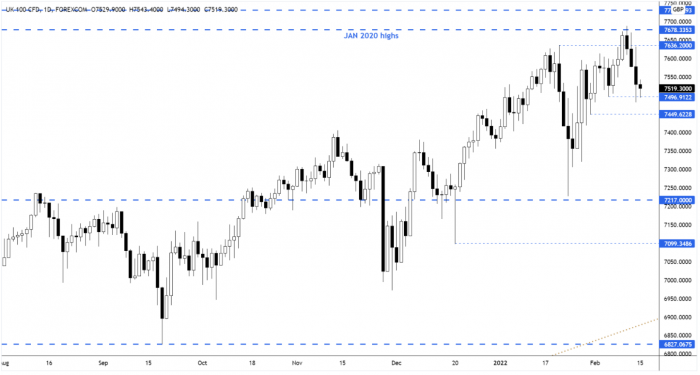

We mentioned in yesterday’s Morning Report that “the next swing support level is around 80 points away at 7,498” and that’s exactly what we saw play out during yesterday’s session with a swift press down into that support level.

We have a smaller interim level of support just below yesterday’s low at 7,449 and a break below this would alter the momentum dynamics of the market.

| Final Results |

| Plus500 (PLUS) |

| Glencore (GLEN) |

| Rm (RM.) |

| Trading Announcements |

| (07:00) Claimant Count Rate |

| (07:00) Unemployment Rate |

| International Economic Announcements |

| (07:00) Consumer Price Index (GER) |

| (10:00) GDP (Preliminary) (EU) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.