14th Jun 2022. 7.46am

Regency View:

Morning Report – Tuesday 14th June

FTSE to open at 7,257 (+51 pts)

Wall Street plunged into bear market territory yesterday as the prospect of aggressive monetary tightening rattled traders…

The S&P 500 broke to new 12-month lows, marking more than a 20% sell-off from its highs – and meeting the criteria for a bear market to be called. The US dollar hit highs not seen since 2002 and the yield on US 10yr Treasury’s broke to new highs for the year.

Asian stocks mirrored the losses on Wall Street in early trading, but the Hang Seng has since regained ground and moved into positive territory.

| S&P 500 | -3.88% | Bearish for UK stocks |

| Hang Seng | +0.27% | Bullish for UK stocks |

| Gold | +0.52% | Bearish for UK stocks |

| AUD/JPY | +0.76% | Bullish for UK stocks |

| US 10yr Yield | +194pts | Bearish for UK stocks |

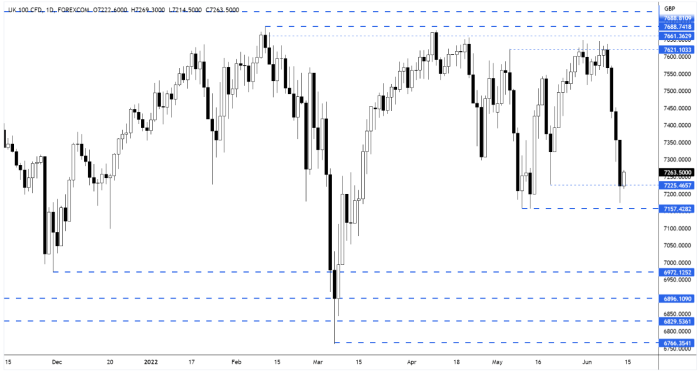

Yesterday’s price action saw the FTSE come within touching distance of the May 10th and May 12th swing low at 7,157 – a key area of support.

This morning’s pre-open price action has seen the market bounce from the support area, but this looks to be a small pullback rather than a new inflection point.

| Final Results |

| Oxford Instruments (OXIG) |

| Interim Management Statement |

| Crest Nicholson (CRST) |

| Paragon Group (PAG) |

| Trading Announcements |

| Bellway (BWY) |

| UK Economic Announcements |

| (06:00) Claimant Count Change (May) |

| (06:00) ILO Unemployment Rate (3M)(Apr) |

| International Economic Announcements |

| (06:00) German Harmonized Index of Consumer Prices (YoY)(May) (EUR) |

| (09:00) German ZEW Survey – Economic Sentiment (Jun) (EUR) |

| (12:30) US Producer Price Index ex Food & Energy (YoY)(May) (USD) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.