11th May 2021. 7.45am

Regency View:

Morning Report – Tuesday 11th May

FTSE to open at 7,038 (-86 pts)

A strong sell-off during the later half of US trading saw the S&P fall back towards last week’s lows yesterday, and the bearish sentiment has continued into Asia trading.

It’s being widely reported that the sell-off is being driven by inflationary fears, heightened by the upcoming release of Wednesday’s US consumer price index report.

| S&P 500 | -1.04% | Bearish for UK stocks |

| Hang Seng | -1.77% | Bearish for UK stocks |

| Gold | -0.01% | Neutral for UK stocks |

| AUD/JPY | +0.16% | Neutral for UK stocks |

| US 10yr Yield | +0.01% | Neutral for UK stocks |

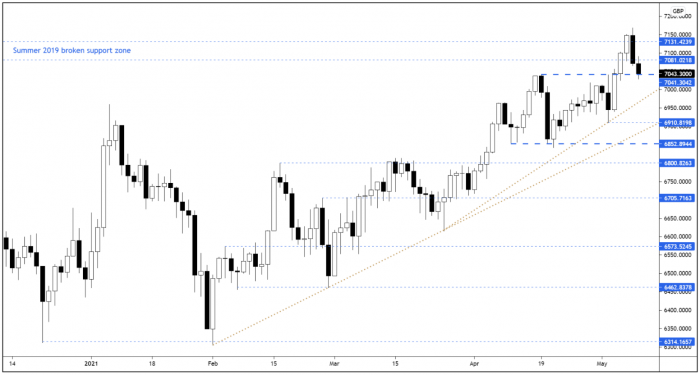

The FTSE failed to continue its breakout move in some style yesterday, closing back below Friday’s lows and forming a bearish engulfing.

Overnight, we’ve seen the futures continue to sell-off, taking prices back to the broken swing highs – an area that may potentially provide some support.

| Final Results |

| Air Partner (AIR) |

| Angling Direct (ANG) |

| Interim Results |

| Treatt (TET) |

| Zytronic (ZYT) |

| Q1 Results |

| Arrow Global (ARW) |

| Trading Announcements |

| WM Morrison (MRW) |

| UK Economic Announcements |

| (00:01) Retail Sales |

| International Economic Announcements |

| (10:00) ZEW Survey (GER) – Current Situation |

| (10:00) ZEW Survey (EU) – Economic Sentiment |

| (10:00) ZEW Survey (GER) – Economic Sentiment |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.