9th Jun 2022. 7.44am

Regency View:

Morning Report – Thursday 9th June

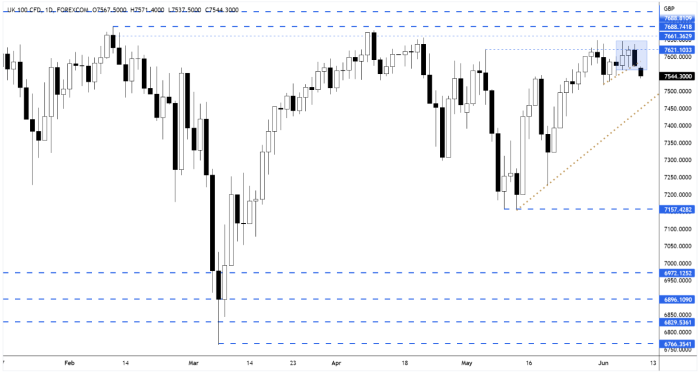

FTSE to open at 7,550 (-43 pts)

Stocks on Wall Street continued to chop sideways yesterday with the S&P 500 locked in a small trading range on thin summer volumes.

Overnight in Asia, China reported stronger-than-expected exports in May, but new Shanghai lockdown restrictions saw stocks move lower.

All eyes will be fixed on the ECB today with the central bank announcing its interest rate decision and publishing its monetary policy statement.

| S&P 500 | -1.08% | Bearish for UK stocks |

| Hang Seng | -1.05% | Bearish for UK stocks |

| Gold | -0.16% | Neutral for UK stocks |

| AUD/JPY | -0.43% | Bearish for UK stocks |

| US 10yr Yield | +50pts | Bearish for UK stocks |

Yesterday’s price action saw the FTSE futures close near the lows of the inside day pattern that we identified yesterday.

This morning we have seen the futures break below the inside day pattern – set up a press down into 7,500.

| Final Results |

| Mitie (MTO) |

| Tate & Lyle (TATE) |

| Peel Hunt (PEEL) |

| International Economic Announcements |

| (11:45) ECB Interest Rate Decision (EUR) |

| (11:45) ECB Monetary Policy Decision Statement (EUR) |

| (12:30) ECB Press Conference (EUR) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.