8th Apr 2021. 7.44am

Regency View:

Morning Report – Thursday 8th April

FTSE to open at 6,902 (+17 pts)

US stocks consolidated their gains yesterday with another steady session at the highs, as the Fed underlined its commitment to keep policy loose even as the economy enjoys a rapid recovery.

This bullish sentiment has followed through into Asian trading with the Hang Seng back at highs for the week.

Our risk barometer is in neutral territory, and we’re likely to see quiet start to European trading following yesterday’s gains.

| S&P 500 | +0.15% | Neutral for UK stocks |

| Hang Seng | +1.19% | Bullish for UK stocks |

| Gold | +0.35% | Neutral for UK stocks |

| AUD/JPY | +0.13% | Neutral for UK stocks |

| US 10yr Yield | -0.85% | Neutral for UK stocks |

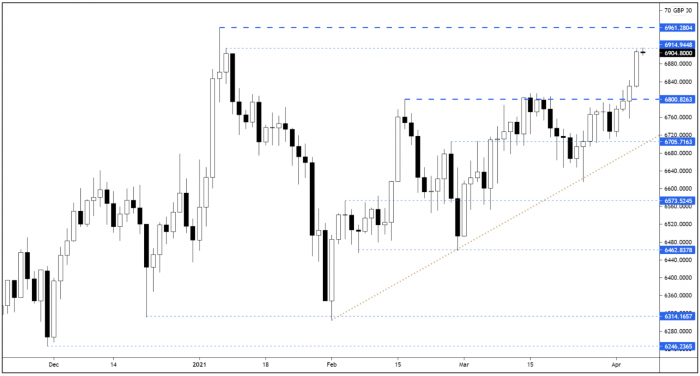

The FTSE put in a strong ‘trend day’ yesterday – taking the market within touching distance of the New Year highs.

After such strong trend days, we’d typically expect to see some form of mean reversion or consolidation during today’s session, but there is no doubting that both the trend structure and short-term momentum are firmly bullish.

| Final Results |

| Equals Gp (EQLS) |

| M Winkworth (WINK) |

| OneSavings Bank (OSB) |

| Interim Results |

| Tracsis (TRCS) |

| Trading Announcements |

| Dunelm (DNLM) |

| Entain (ENT) |

| Ferrexpo (FXPO) |

| UK Announcements |

| (07:00) Factory Orders (GER) |

| International Economic Announcements |

| (07:00) Factory Orders (GER) |

| (09:30) PMI Construction (US) |

| (10:00) Producer Price Index (EU) |

| (13:30) Continuing Claims (US) |

| (13:30) Initial Jobless Claims (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.