7th Oct 2021. 7.46am

Regency View:

Morning Report – Thursday 7th October

FTSE to open at 7,071 (+75 pts)

Global stocks have been lifted on hopes that politicians in Washington are close to a temporary deal that would avoid a shutdown of the U.S. government and see an extension of the federal debt ceiling into December.

This morning’s UK house price data came in ahead of expectations, showing a 1.7% increase month-on-month for September versus 0.8% expected, and a 7.4% year on year for Q3 versus 4.9% expected.

| S&P 500 | +0.41% | Bearish for UK stocks |

| Hang Seng | +2.69% | Bullish for UK stocks |

| Gold | -0.08% | Bearish for UK stocks |

| AUD/JPY | +0.28% | Bullish for UK stocks |

| US 10yr Yield | -0.37% | Bearish for UK stocks |

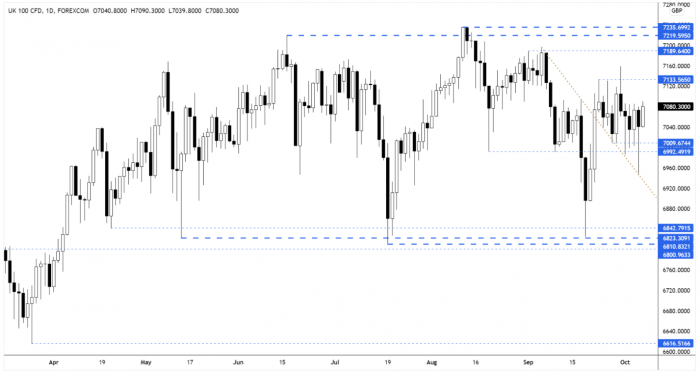

We saw volatility increase yesterday as the market whipsawed more than 120 points, breaking lower at first before bouncing back.

The futures are now sat just below the cluster of highs that have formed during the last four sessions – a swift break above thos highs at the open should see the market press up into 7,133.

| Final Results |

| Eenergy Group (EAAS) |

| Volution Group PLS (FAN) |

| Interim Results |

| Morses Club (MCL) |

| Trading Announcements |

| Entain (ENT) |

| Mondi (MNDI) |

| UK Economic Announcements |

| (07:00) Halifax House Price Index |

| International Economic Announcements |

| (07:00) Industrial Production (GER) |

| (13:30) Continuing Claims (US) |

| (13:30) Initial Jobless Claims (US) |

| (20:00) Consumer Credit (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.