6th Oct 2022. 7.43am

Regency View:

Morning Report – Thursday 6th October

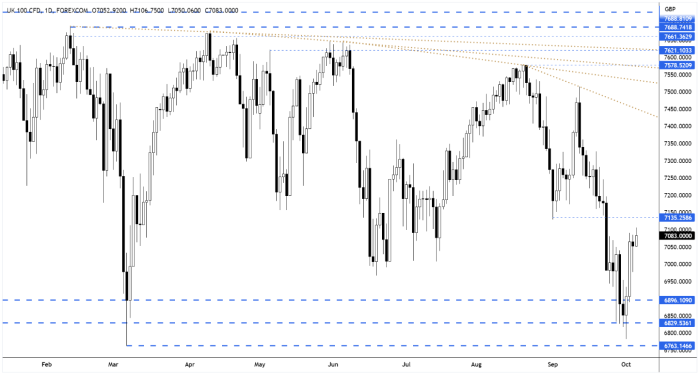

FTSE to open at 7,088 (+35 pts)

US stocks tread water yesterday as Treasury yields started to rally again.

Asian markets are mixed, with Hong Kong’s Hang Seng posting small losses and Japan’s Nikkei 225 up 0.70%.

In Europe, this morning’s German industrial orders shrunk more than expected, falling 2.4% between July and August, adding evidence that the country has already entered a recession.

| S&P 500 | -0.20% | Neutral for UK stocks |

| Hang Seng | -0.39% | Bearish for UK stocks |

| Gold | +0.38% | Bearish for UK stocks |

| AUD/JPY | +0.41% | Bullish for UK stocks |

| US 10yr Yield | +126pts | Bearish for UK stocks |

Yesterday’s price action saw the FTSE daily rolling futures form a small ‘inside hammer candle’.

This is a classic consolidation pattern and signals upside continuation, which we are already starting to see from this morning’s pre-open price action.

| Final Results |

| Avation (AVAP) |

| Trading Announcements |

| Rs Group (RS1) |

| Interim Management Statement |

| City Of London (CIN) |

| UK Economic Announcements |

| (09:30) PMI Construction |

| International Economic Announcements |

| (07:00) Factory Orders (GER) |

| (10:00) Retail Sales (EU) |

| (13:30) Continuing Claims (US) |

| (13:30) Initial Jobless Claims (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.