4th Aug 2022. 7.47am

Regency View:

Morning Report – Thursday 4th August

FTSE to open at 7,437 (-9 pts)

US tech stocks hit their highest level in three months yesterday, lead by PayPal which surged more than 9% due to better than expected quarterly earnings.

The bullish sentiment on Wall Street has carried through into Asian trading despite China launching military exercises near Taiwan in rebuke over Nancy Pelosi’s visit to the country.

All eyes will be on the Bank of England today which is expected to hike interest rates by 50 basis points to 1.75% – the biggest rate rise in 27 years.

| S&P 500 | +1.56% | Bullish for UK stocks |

| Hang Seng | +1.64% | Bullish for UK stocks |

| Gold | +0.29% | Bearish for UK stocks |

| AUD/JPY | +0.54% | Bullish for UK stocks |

| US 10yr Yield | -49pts | Bullish for UK stocks |

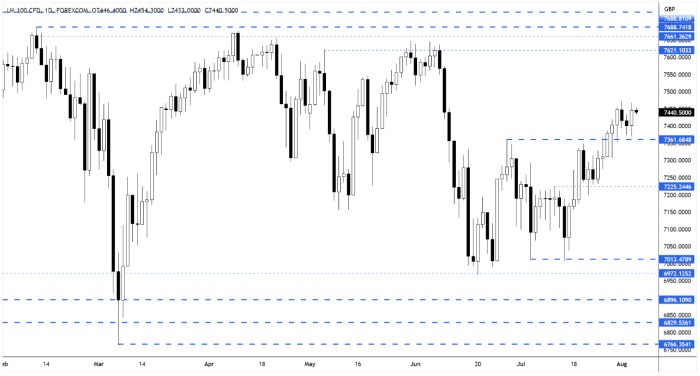

Yesterday’s price action saw the market rally from the broken resistance turned support area at 7,361 that we’ve highlighted in previous reports.

A retest of Monday’s highs now looks likely with short-term momentum suggesting that the market will break higher.

| Final Results |

| Revolution Bg (REVB) |

| Interim Results |

| Evraz (EVR) |

| Mondi (MNDI) |

| Morgan Sindall Group (MGNS) |

| Glencore (GLEN) |

| ConvaTec (CTEC) |

| Mears (MER) |

| Coca-cola Euro. (CCEP) |

| Spirent (SPT) |

| Hikma Pharmaceuticals (HIK) |

| Gym Grp (GYM) |

| Trading Announcements |

| Next (NXT) |

| Sndrsn Dsn (SDG) |

| UK Economic Announcements |

| (09:30) PMI Construction |

| (12:00) BoE Interest Rate Decision |

| International Economic Announcements |

| (07:00) Factory Orders (GER) |

| (10:00) Retail Sales (EU) |

| (13:30) Continuing Claims (US) |

| (13:30) Initial Jobless Claims (US) |

| (13:30) Balance of Trade (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.