30th Jun 2022. 7.45am

Regency View:

Morning Report – Thursday 30th June

FTSE to open at 7,190 (-122 pts)

The S&P 500 printed its narrowest daily range in nearly a month as weak summer volumes stiffed volatility.

Overnight in Asia, the Hang Seng has weakened despite data showing China’s pandemic-induced economic slowdown looked to be bottoming out.

This morning’s final UK GDP numbers for Q1 came in in-line with expectations (0.8% QoQ and 8.7% YoY), while house price data from nationwide indicated that the UK housing market was cooling faster than expected.

| S&P 500 | -0.07% | Neutral for UK stocks |

| Hang Seng | -0.97% | Bearish for UK stocks |

| Gold | -0.10% | Neutral for UK stocks |

| AUD/JPY | -0.09% | Neutral for UK stocks |

| US 10yr Yield | -86pts | Bullish for UK stocks |

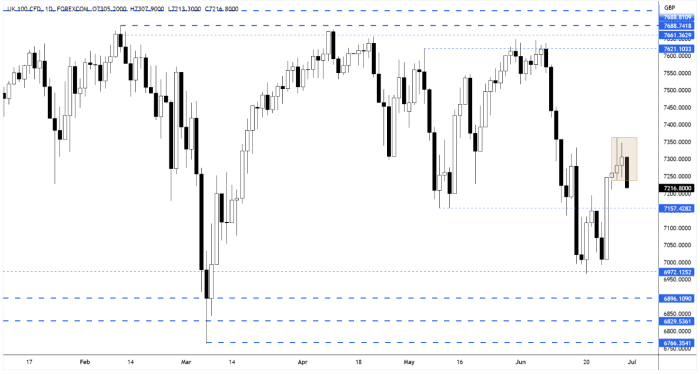

Yesterday’s price action on the FTSE daily rolling futures was fully contained within Tuesday’s range – forming an ‘inside day’ pattern (see gold box on chart below).

This morning’s pre-open price action has seen the market break decisively below the inside day pattern and this is a bearish sign.

| UK Economic Announcements |

| (06:00) Gross Domestic Product (QoQ)(Q1) |

| International Economic Announcements |

| (06:00) German Retail Sales (YoY)(May) |

| (07:55) German Unemployment Change (Jun) |

| (09:00) European Unemployment Rate (May) |

| (12:30) US Initial Jobless Claims (Jun 24) |

| (12:30) US Personal Income (MoM)(May) |

| (13:45) US Chicago Purchasing Managers’ Index (Jun) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.