2nd Sep 2021. 7.48am

Regency View:

Morning Report – Thursday 2nd September

FTSE to open at 7,128 (-22 pts)

A quiet US trading session has fed through into Asia with Hong Kong’s Hang Seng giving up early gains to trade flat on the day.

Looking ahead today we have US Initial Jobless claims – analysts expect another drop in Jobless claims to 345k from 353k the week prior.

| S&P 500 | +0.03% | Neutral for UK stocks |

| Hang Seng | -0.05% | Neutral for UK stocks |

| Gold | +0.05% | Neutral for UK stocks |

| AUD/JPY | +0.24% | Bullish for UK stocks |

| US 10yr Yield | -0.85% | Bearish for UK stocks |

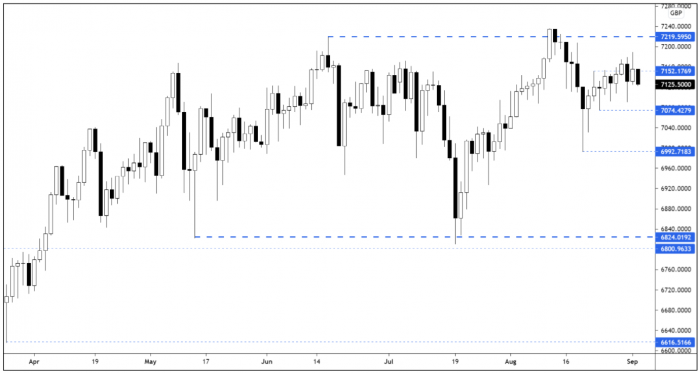

The FTSE has had a very indecisive start to this shortened trading week…

An 80 point drop on Tuesday was followed by a 100 point peak-to-trough rally yesterday and at the time of writing, the FTSE futures are back where they closed on Tuesday.

This choppy indecision tell us that there’s a lack of conviction from both bulls and bears – creating a high degree of randomness within short-term price action.

| Final Results |

| Barratt Developments (BDEV) |

| Trading Announcements |

| Camellia (CAM) |

| Downing Renewa (DORE) |

| Gem Diamonds Di (GEMD) |

| Gulf Keystone Petroleum (GKP) |

| Inspired (INSE) |

| Gym Grp (GYM) |

| Wentworth Res. (WEN) |

| International Economic Announcements |

| (10:00) Producer Price Index (EU) |

| (13:30) Initial Jobless Claims (US) |

| (13:30) Continuing Claims (US) |

| (15:00) ISM Prices Paid (US) |

| (15:00) ISM Manufacturing (US) |

| (15:00) Factory Orders (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.