2nd Dec 2021. 7.43am

Regency View:

Morning Report – Thursday 2nd December

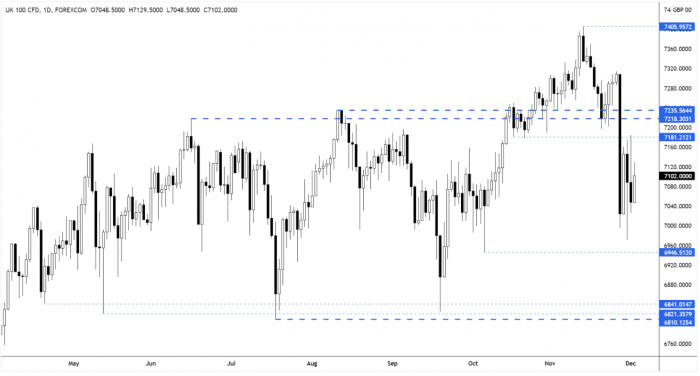

FTSE to open at 7,100 (-69 pts)

Stocks on Wall Street traded lower into the New York closing bell yesterday as the Fed’s seeming determination to tighten monetary policy regardless of the Omicron variant left many traders fearful.

While overnight in Asia, stocks and major currencies paused for breath as markets struggled to find direction in the absence of solid information about the Omicron variant.

This afternoon, we have US initial jobless claims for the week of 26 Nov, and ISM manufacturing data also from the US.

| S&P 500 | -1.18% | Bearish for UK stocks |

| Hang Seng | +0.48% | Bullish for UK stocks |

| Gold | -0.30% | Bullish for UK stocks |

| AUD/JPY | +0.40% | Bullish for UK stocks |

| US 10yr Yield | -3.10% | Bullish for UK stocks |

The whipsaw price action continued yesterday as the market initially tested the top of the weekly range before reversing.

As mentioned yesterday, the longer this whipsaw in the lower half of Friday’s range continues, the higher the probability of further downside.

| Final Results |

| Oxford Metrics (OMG) |

| Auction Tech (ATG) |

| Aj Bell (AJB) |

| Interim Results |

| Srt Marine Sys. (SRT) |

| Induction Heal. (INHC) |

| Trading Announcements |

| Go-Ahead (GOG) |

| International Economic Announcements |

| (15:00) ISM Prices Paid (US) |

| (13:30) Initial Jobless Claims (US) |

| (09:00) Unemployment Rate (EU) |

| (10:00) Producer Price Index (EU) |

| (15:00) ISM Manufacturing (US) |

| (13:30) Continuing Claims (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.