29th Sep 2022. 7.47am

Regency View:

Morning Report – Thursday 29th September

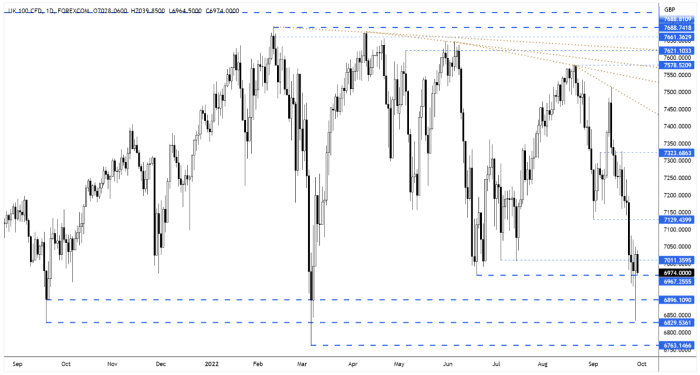

FTSE to open at 6,985 (-20 pts)

Stocks on Wall Street rallied from support yesterday as bond markets calmed and the yield on US 10yr Treasuries eased back from highs.

While the Bank of England took emergency action to prop up the gilt market, unleashing a £65bn bond-buying programme.

Overnight in Asia, shares in Hong Kong gave up their early gains after the Hang Seng’s two largest IPO’s of the year opened sharply lower on their debuts.

| S&P 500 | +1.97% | Bullish for UK stocks |

| Hang Seng | -0.56% | Bearish for UK stocks |

| Gold | -0.92% | Bullish for UK stocks |

| AUD/JPY | -0.65% | Bearish for UK stocks |

| US 10yr Yield | -219pts | Bullish for UK stocks |

Having pressed down into a major area of support, the FTSE put in a large intra-day reversal on Wednesday – forming a bullish ‘pin-bar’ candle.

This large reversal candle signals selling exhaustion and indicates that buyers are stepping back into the market after two-weeks of heavy selling pressure.

| Final Results |

| Cap-xx (CPX) |

| Mcbride (MCB) |

| Allergy Thera. (AGY) |

| Physiomics (PYC) |

| Avation (AVAP) |

| Interim Results |

| Next (NXT) |

| Crestchic (LOAD) |

| Directa Plus (DCTA) |

| ANGLE (AGL) |

| Celadon Pharma. (CEL) |

| Bango (BGO) |

| Xlmedia (XLM) |

| Synairgen (SNG) |

| Novacyt (NCYT) |

| Avacta (AVCT) |

| Trading Announcements |

| Mitchells & Butlers (MAB) |

| UK Economic Announcements |

| (09:30) M4 Money Supply |

| (09:30) Consumer Credit |

| (09:30) Mortgage Approvals |

| International Economic Announcements |

| (10:00) Services Sentiment (EU) |

| (10:00) Industrial Confidence (EU) |

| (10:00) Economic Sentiment Indicator (EU) |

| (10:00) Consumer Confidence (EU) |

| (10:00) Business Climate Indicator (EU) |

| (13:00) Consumer Price Index (GER) |

| (13:30) Personal Consumption Expenditures (US) |

| (13:30) Continuing Claims (US) |

| (13:30) Initial Jobless Claims (US) |

| (13:30) Gross Domestic Product (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.