28th Apr 2022. 7.46am

Regency View:

Morning Report – Thursday 28th April

FTSE to open at 7,484 (+58 pts)

Stocks on Wall Street ended yesterday’s session in mildly positive territory after strong earnings from Microsoft and Visa.

While the euro dropped to its weakest since 2017 after Russia halted gas supplies to Bulgaria and Poland.

In Asia, stocks have rallied from lows in Hong Kong and Japan as China pledged further monetary support to its stuttering economy.

It’s a busy day for corporate earnings with UK banks Barclays and Standard Chartered reporting Q1 numbers, along with trading updates from Glencore, Unilever and Smith & Nephew.

| S&P 500 | +0.21% | Neutral for UK stocks |

| Hang Seng | +0.92% | Bullish for UK stocks |

| Gold | -0.47% | Bullish for UK stocks |

| AUD/JPY | +1.12% | Bullish for UK stocks |

| US 10yr Yield | +105pts | Bearish for UK stocks |

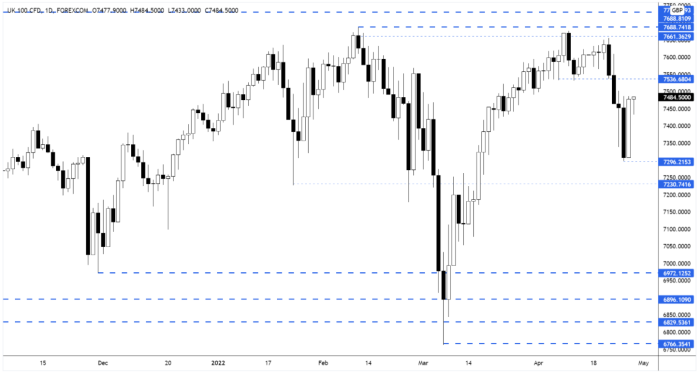

Yesterday’s price action saw the FTSE erase Tuesday’s losses entirely – forming a bullish ‘two-bar reversal’ pattern.

Should the market break and hold above yesterday’s highs during the opening rotation, then a rally back towards the broken support level at 7,536 looks the most probable scenario.

| Final Results |

| Keystone Law G. (KEYS) |

| Sainsbury (J) (SBRY) |

| Checkit (CKT) |

| Sndrsn Dsn (SDG) |

| Q1 Results |

| Lancashire Holdings (LRE) |

| Standard Chartered (STAN) |

| Schroders (SDR) |

| Barclays (BARC) |

| Nokia Ord (0HAF) |

| Trading Announcements |

| ConvaTec (CTEC) |

| Evraz (EVR) |

| Howden Joinery (HWDN) |

| Unilever (ULVR) |

| Smith & Nephew (SN.) |

| Glencore (GLEN) |

| Inchcape (INCH) |

| Lancashire Holdings (LRE) |

| International Economic Announcements |

| (12:00) Harmonized Index of Consumer Prices (YoY)(Apr) PREL (EU) |

| (12:30) Gross Domestic Product Annualized (Q1) PREL (US) |

| (12:30) Initial Jobless Claims (Apr 22) (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.