21st Jul 2022. 7.49am

Regency View:

Morning Report – Thursday 21st July

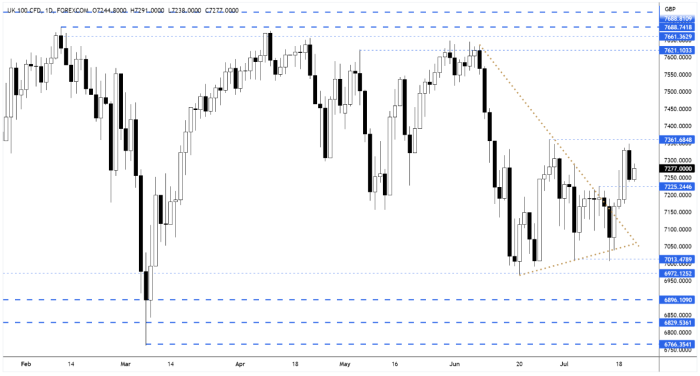

FTSE to open at 7,265 (+1 pt)

The S&P 500 broke to 1-month highs yesterday, but printed its smallest daily range in over seven sessions – indicating that the recent rally is losing momentum.

While in Asia, stocks have been mixed with the Hong Kong’s Hang Seng dropping more than -1% and Japan’s Nikkei 225 bouncing +0.47%.

Russia is set to resume supplies of gas to mainland Europe today at reduced capacity following a 10-day maintenance break – easing fears of a retaliatory gas cut in response to Europe’s military support of Ukraine.

| S&P 500 | +0.59% | Bearish for UK stocks |

| Hang Seng | -1.03% | Bearish for UK stocks |

| Gold | -0.39% | Bullish for UK stocks |

| AUD/JPY | +0.26% | Bullish for UK stocks |

| US 10yr Yield | -4pts | Neutral for UK stocks |

Yesterday’s price action saw the FTSE pullback and erase around half of Tuesday’s breakout gains.

The market needs to hold near Tuesday’s highs in order to maintain the renewed bullish momentum.

| Final Results |

| Fulham Shore (FUL) |

| Redcentric (RCN) |

| Interim Results |

| Howden Joinery (HWDN) |

| Nokia Ord (0HAF) |

| Trading Announcements |

| Diploma (DPLM) |

| Aj Bell (AJB) |

| SSE (SSE) |

| Workspace (WKP) |

| Brewin Dolphin (BRW) |

| Dunelm (DNLM) |

| Qinetiq (QQ.) |

| Close Bros (CBG) |

| Intermediate Capital (ICP) |

| Pensionbee (PBEE) |

| Frasers Grp (FRAS) |

| Dp Eurasia (DPEU) |

| Volution Group PLS (FAN) |

| Mitchells & Butlers (MAB) |

| UK Economic Announcements |

| (07:00) Public Sector Net Borrowing |

| International Economic Announcements |

| (12:45) ECB Interest Rate (EU) |

| (13:15) ECB Monetary Policy Statement (EU) |

| (13:30) Continuing Claims (US) |

| (13:30) Initial Jobless Claims (US) |

| (13:30) Philadelphia Fed Index (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.